Binance to buy Sam Bankman-Fried’s crypto exchange FTX

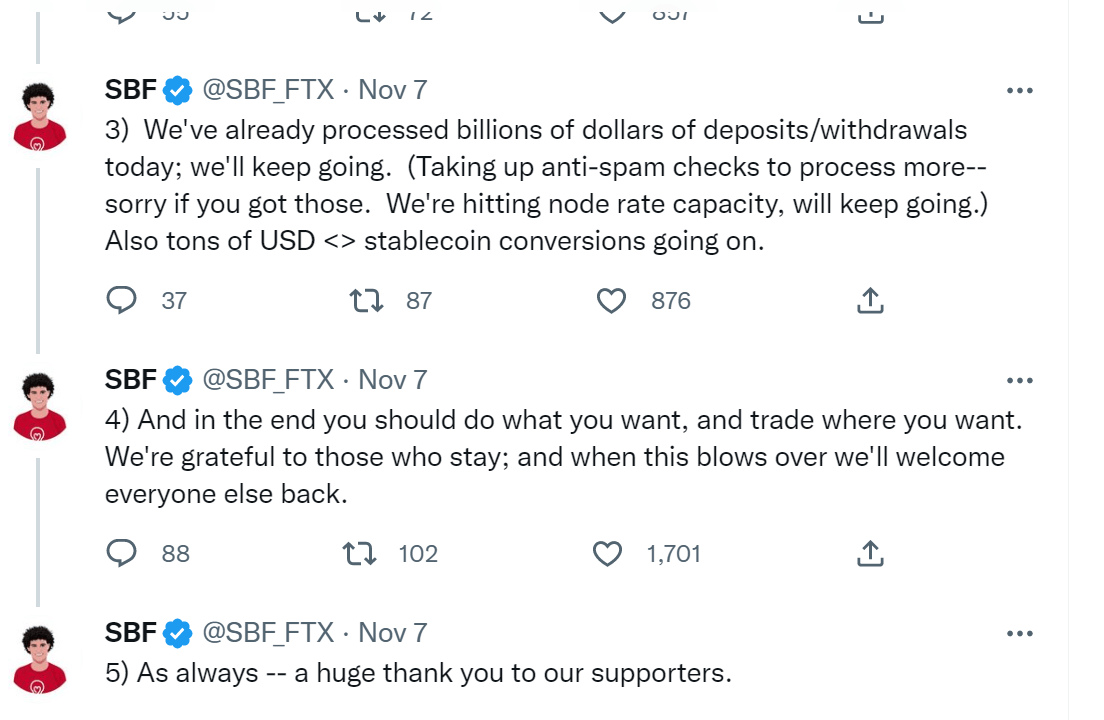

Sam Bankman-Fried, head of one of the largest cryptocurrency exchanges, said he entered into a non-binding letter of intent with rival Binance to acquire FTX business as they face the worst of a liquidity crunch.

Binance CEO Changpeng “CZ” Zhao confirmed the insolvency news and posted the following tweet about the possible buyout, which is pending the full diligence in the coming days.

“This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire http://FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days.”

Zhao – who declared yesterday that his exchange would soon dump hundreds of millions of dollars in FTX’s native token – said that Binance has the discretion to pull out from the deal at any time.

According to Tweets from both Zhao and Bankman-Fried, the takeover impacts only the non-US businesses, FTX.com. The US offshoots of both crypto giants, Binance.US and FTX.us, will remain independent of the deal.

Binance’s Zhao added in a tweet that “there is a lot to cover and will take some time. This is a highly dynamic situation, and we are assessing the situation in real time. We expect FTT to be highly volatile in the coming days as things develop.”

The news was shocking as Bankman-Fried has emerged recently as the industry’s white knight, throwing lifelines to many crypto lenders and digital asset brokers which have faltered as cryptocurrencies prices have cratered.

The news comes hot on the heels of CZ declaring that Binance is liquidating its stash of FTT token, which triggered mass withdrawals from FTX with outflows reaching a whopping $451 million. On the other hand, Binance has seen net inflows of more than $411 million over the same period.

A liquidity crisis at a cryptocurrency giant like FTX would make investors worried about a broader contagion that could bring down other major players in the market. However, the native token of Sam Bankman-Fried’s cryptocurrency exchange FTT jumped by 35 percent in the last 45 minutes.

Last week, Bankman-Fried, who is from California but lives in the Bahamas where FTX is based, floated the idea of issuing FTX’s very own stablecoin. And FTX was reportedly in discussions with a clutch of heavyweights from traditional finance to raise up to $1 billion in fresh funding to fuel more deal-making.

The fresh capital injection, which was still subject to negotiations, would keep the crypto conglomerate at the same valuation it had landed after a $400 million funding round back in January. At the time, the cryptocurrency exchange founded by Sam Bankman-Fried was valued at $32 billion.

Commenting on Binance’s acquisition of FTX, Marieke Fament CEO of the NEAR Foundation – which oversees development and funding for Dapps built on NEAR layer 1 Protocol, said:

“Consolidation is inevitable in crypto’s current bear market – but the silver lining is that we can now separate the hype and noise from the applications that have real world utility and the leaders that are making significant and valuable contributions to the future of our sector. There’s nowhere to hide during crypto winter – and developments such as the acquisition of FTX by Binance underscores the challenges and lack of transparency behind the scenes of some key players – which undermine the reputation of crypto. Moving forward, the ecosystem is going to learn from these mistakes and hopefully create a stronger sector that puts honesty, transparency and consumer protection at the heart of their businesses.”