Binary options brokers get blacklisted. So what?

FinanceFeeds’ Managing Editor scrutinized a blacklist of 315 unregulated binary options brokers: she got bonus offers, calls, computer viruses and a headache.

There has been some hectic activity by regulators in many jurisdictions seeking to either tighten the oversight of the binary options sector or ban binary options altogether. Even EUROPOL has been reported to have joined the fight against binary options fraud.

And yet, the regulators’ best friends when it comes to tackling binary options scams are the warnings and the blacklists of unregulated companies. Are these lists and warnings worth anything? What happens to the companies that are included in a blacklist?

FinanceFeeds’ Managing Editor Maria Nikolova decided to check the blacklist regularly updated by France’s AMF – the nation’s financial markets authority. AMF has been known for actively pushing for banning advertising of risky products like binary options – that ban was included in the Sapin 2 law. So, it seemed like a natural choice to check out the Blacklist of binary options firms’ websites that target French investors but do not have the regulatory permission to do so.

Here is what happened.

B-b-b-bad to the bone

The latest version of AMF’s “Blacklist” features 315 websites of binary options firms. Necessary credit should be given to the ingenious people who come up with the names of these “entities”. My personal favourite is “La Bastille and Partners” – poetic and pathetic.

The Swiss theme is also present in many of the names of these illegal companies.

As one might have guessed, the percentage of websites that are now not active is relatively high – around 80%, or 252 websites.

At least 16 of these websites install malicious software on the visitor’s computer.

And, of course, there are 63 websites that are still active and who have disregarded the warnings and blacklisting.

The advertising

Only nine of the active websites do not have a French-language version of their websites, that is, they may allow opening of accounts by French investors but they are not openly targeting French investors.

The remainder have no problem advertising their binary options services – binaries are hailed as easy to master and as very profitable. Campaigns that reward traders for referring friends and depositing hefty amounts of money are a common feature of most websites. Profits are presented as guaranteed. The bonuses (on deposit) I was promised reach 200% of the sum I dare to deposit.

Meanwhile, the logos of the London Stock Exchange and NYSE greeted me from several websites.

I saw no advertising of football clubs partnerships. However, I encountered a few examples of advertising via female boxing.

Barclays (not the real one)

To illustrate the bonus offer avalanche I got under, here is an example from a company that calls itself Barclays Broker and that has invited me to complete a questionnaire with “Barclays” to receive a GBP 50 bonus. This is how much 30 sec of my time and a lifetime loss of my data are worth.

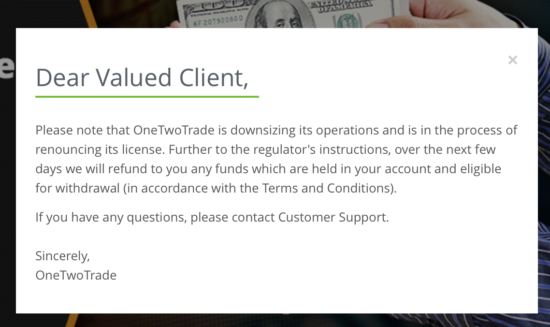

This one is closing

Some of the companies are going out of business. OneTwoTrade, claiming to be registered and authorized in Malta, has a message on its frontpage saying it is going out of business. Let’s hope the clients managed to get their funds back.

The friendly call

Reminding me to read what I sign, here is a part of the agreement with one of the brokers:

“From time to time Owpremium may contact clients whether by phone or email for the purpose of offering them further information about Owpremium, binary options trading or financial market trading. In addition the company may, on occasion, seek to contact clients, whether by phone or by email, for the purpose of informing them of unique promotional offerings provided by Owpremium for the client. Clients consent to the receipt of such contact when they consent to our terms and conditions of use when registering with Owpremium.”

So long, privacy! Welcome, binary options sales agents!

Change of heart

After some of the companies have abandoned their websites, these now serve different purposes – some simply steal visitors’ data. Others belong to companies that claim to be helpful in recovering the losses from the activities of a given binary options broker. It is needless to say, but, please, stay away!

Here are some of the new roles that the domains of binary options brokers now have. They sell:

- organic clothing;

- food products, such as protein shakes;

- pirated video games;

- dentist office equipment.

A website that once belonged to a binary options firm tried to lure me to buy a Rolex watch from a pawn shop. That officially brought the check of the blacklist to an end.