Binary options twilight era part 2: RoboOption closes OptionRally lets 50 staff go

RoboForex closed its binary options operations RoboOption, and OptionRally, one of SpotOption’s largest brands, has begun a restructure, making 50 sales people redundant in Cyprus but maintaining back office operations in Israel.

Yet another chapter in FinanceFeeds’ investigation into the sustainability, or lack thereof, of the binary options industry, and a large casualty has come about.

During the past few weeks, FinanceFeeds has reported that the twilight era is being entered for retail OTC binary options firms, owing to mainstream media reports casting dissent over the entire business which consists of approximately 300 brands which use platforms provided by 6 dedicated providers.

Today, FinanceFeeds has discovered that RoboOption, the binary options division of RoboForex, has closed its operations.

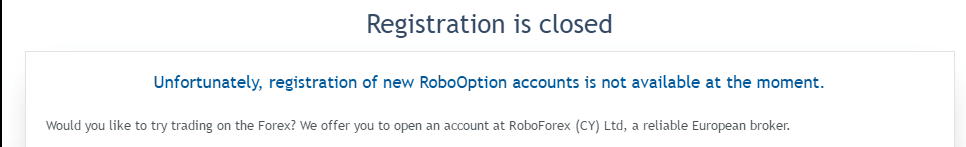

When attempting to register for a new account, this message appears:

The retail FX division of RoboForex continues in its full form, however registration and trading on the binary options brand has ceased.

FinanceFeeds reached out to the firm’s CEO today in order to establish why this decision was made, however no answer was provided. It is our understanding that the negative media pressure surrounding retail binary options was a factor.

It is not just binary options divisions of FX firms that have begun to succumb to unsustainability. This is more serious when looking at actual dedicated binary options brands which do not operate in the FX business at all.

OptionRally, which uses the SpotOption platform and has offices in Tel Aviv, Israel and Limassol, Cyprus, begun a complete restructure, having made a large proportion of its sales team redundant in Cyprus, which according to sources, amounts to approximately 50 people.

FinanceFeeds research deduced that the retention staff and back office administrators based in Tel Aviv remain with the company, the vast exodus being largely sales staff.

OptionRally was initially founded in 2010, in the Sonol Tower, in South Tel Aviv, Israel, by a group of partners led by former SuperDerivatives software engineer Tal Fromchenko.

The company began to expand in 2013, gaining a CySec license and opening an office in Limassol, Cyprus at a later stage.

In its initial form, OptionRally was one of SpotOption’s largest brands, with over 85 members of staff at its Tel Aviv offices by 2012, with organic desks selling binary options to retail customers across Europe and the Middle East, with sales staff based in Tel Aviv, speaking multiple languages.

The office in Tel Aviv was a hive of activity back in 2012 prior to OptionRally’s expansion into Cyprus, and embodied the now well-worn model among binary options brands of calling lead lists which in many cases have been purchased from affiliated entities in the online gambling sector in order to extract first time deposits which are often blown within the same day, before passing the lead to a retention desk whose duty it is to extract a further deposit which is then often blown quickly.

After this process, in many cases, the customer often then does not deposit more – after all, most binary options brands have as much in common with the financial markets industry as penguins do with potatoes, in that most of the ethos behind the binary options business emulates that of an online casino and the customer lists are often compatible with gaming rather than financial markets.

To gain full perspective on the rationale behind this restructure, FinanceFeeds approached Ayal Carmeli, Chief Marketing Officer at OptionRally today, who was extremely cryptic in his replies. When asked to elaborate on the restructuring, he provided single word answers such as “Restructure.” When asked to elaborate further, he said “working in all regulated markets” which appeared to be at odds with the question asked as to why the firm was restructuring its operations.

Mr. Fromchenko, the firm’s CEO, has been unavailable for comment.

Local regulatory authorities in Cyprus, Canada, Israel, United States, Britain, Australia and New Zealand have over the past few years issued warnings against unlicensed binary options companies soliciting in their region. In some cases against firms that are regulated in one jurisdiction but do not have a license to operate in another, which is an attempt to raise awareness among retail customers of the potential perils of ‘investing’ in binary options as best possible with no actual legal jurisdiction over preventing it.

So far, only two countries have outlawed retail OTC binary options completely, those being the United States and Israel. In the United States, binary options must be executed through one of two dedicated central exchanges, NADEX and Cantor Exchange.

These are absolutely rooted in the center of institutional financial technology and exchange listed derivatives – Chicago – and are completely committed to providing a correct financial markets trading system, with currency contracts executable on exchange, as well as CME Group’s E-mini S&P500 index, bitcoin futures and China 50 which is based on the SGX (Singapore Exchange), FTSE, Xinhua and China A50 indexes.

The heat is most certainly on, and when considering that the methods by which binary options are sold have not only been the subject of recent mainstream media attention, but also the actual sales-driven model in which the average cost of acquisition is between $500 and $700 for a new client, whereas the average first time deposit is approximately $300 to $500 with a very short trader lifetime value, retention and automated methods of gaining clients and engaging them are the only potentially sustainable way of operating, thus avoiding criticism for high pressure sales tactics and also going some way toward reducing operating costs.