Binary options marketing firm that sent more than 60 million fraudulent emails denies CFTC allegations

Zilmil, which has to defend itself in a case brought by the CFTC, denies allegations about redirecting customers to binary options websites and sending more than 60 million fraudulent emails.

It was in July this year, that the United States Commodity Futures Trading Commission (CFTC) launched a case against several binary options firms accusing them of violating the Commodity Exchange Act (CEA). The case also targeted Michael Shah and his company Zilmil, Inc., acting as third-party affiliate marketers to the entities run by Jason B. Scharf. Mr Scharf has been doing business as Citrades.com and AutoTradingBinary.com, He also controls a number of companies, including CIT Investments LLC, a Nevada limited liability corporation; Brevspand EOOD, a Bulgarian business entity; CIT Investments Ltd., a Marshall Islands business entity; CIT Investments Ltd., an Anguillan business entity; and A & J Media Partners, Inc., a California corporation.

Zilmil and Shah (the so-called “Zilmil defendants”) have filed a 17-page answer to the CFTC complaint, seeking to defend themselves against the allegations made by the US regulator. The bulk of the document is dedicated to simple statements saying that the defendants deny the allegations.

In particular, the Defendants deny that Zilmil created and operated the “landing pages” that CFTC enlisted in the its Complaint. According to the US regulator, the list of these landing pages includes: autobinarybot.com; binaryarbitrages.com; binarycashbot.com; binarygenetic.com; thebinaryformula.com; binaryoverdrive.com; binaryturbotrial.com; probinarytips.com.

The CFTC alleges that Zilmil used more than 20 autotrading systems to funnel customers to binary options firm Citrades. According to the CFTC, during the relevant period (from at least January 2014 to present), binary options websites paid more than $3.6 million in commissions to Zilmil. At least $500,000 of these commissions came from Citrades. On top of that of that, Zilmil made $5 million from the sale of its “autotrading systems”.

In their most recent court filing, the Defendants admit that Zilmil received compensation from Citrades for advertising. However, the company denies it received commissions. Also, Zilmil denies it sold autotrading systems.

Let’s recall that the operator of one of the websites to which Zilmil allegedly drove traffic wrote to Shah that:

“the autotrader attached to this is doing its job and is doing it great, crushing people like immediately”.

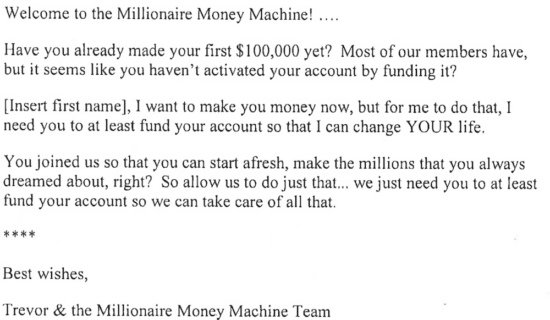

Zilmil is also making an effort to contest the CFTC findings about fraudulent emails. According to the US regulator, Zilmil sent more than 60 million fraudulent emails to more than 1.4 million unique email addresses in a seven-month period. One of the emails concerning the “Millionaire Money Machine” can be viewed below (the source being the CFTC Complaint filed with the Court).

The CFTC has alleged that the emails in question contain numerous false or misleading statements and omissions. For example, the emails purport to be sent by “Trevor” or “Corey Robins” when in fact they were written and sent by Zilmil. Zilmil says it did not send these emails.

Zilmil’s answer also includes assertions that the company “acted in good faith” and that neither the company nor Shah offered to enter into, entered into, confirmed the execution of, maintained positions in, or otherwise conducted activities relating to commodity options.

The list of defenses finishes with an affirmative defense stating that “Plaintiff’s claims are barred in whole or in part to the extent alleged transactions occurred outside the United States or with non-U.S. Residents.” This is a formal question for the Court to rule on, but it is a fact that Zilmil is a Florida Corporation, whereas Shah is a Jacksonville, Florida resident. CFTC has a right under 7 U.S.C. § 13-a – 1(e) to bring such action at this particular venue, that is, the Florida Middle District Court, if the defendants are found in, inhabit or transact business in the Middle District of Florida.

In August this year, the Court approved the CFTC’s Motion for Preliminary Injunction against the defendants in this case. The Court also appointed Kenneth Dante Murena as Permanent Receiver with respect to the Defendants.

The case is captioned Commodity Futures Trading Commission v. Scharf et al (3:17-cv-00774).