Binary Options’ scam labelling by regulators; unfair or well deserved? Op-ed

This op-ed and all opinions included in this editorial are my own. Regulators from the US through to New Zealand are putting a lot of effort into labeling OTC binary options as a scam or ponzi scheme with regular notices about brokerages that are scamming unsuspecting retail customers to creative infographics that outline “How not […]

This op-ed and all opinions included in this editorial are my own.

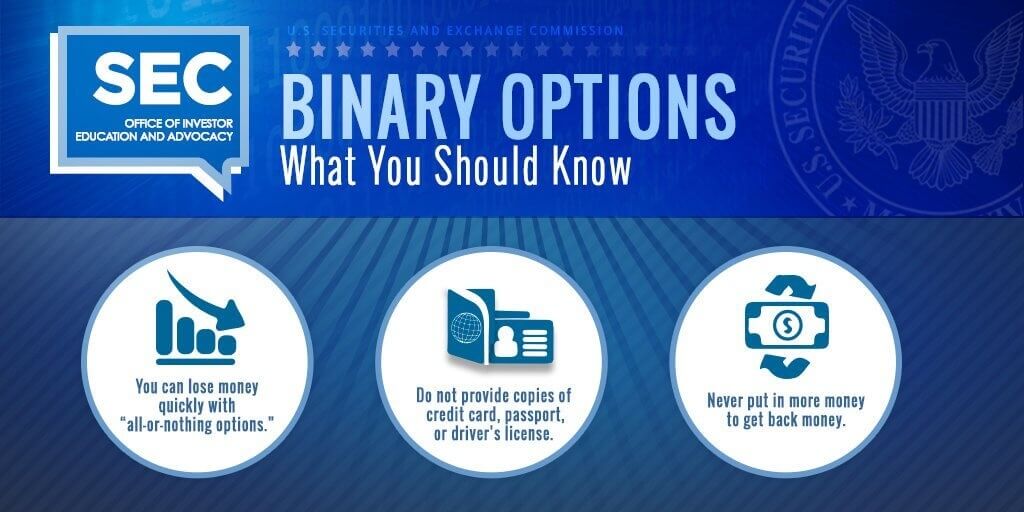

Regulators from the US through to New Zealand are putting a lot of effort into labeling OTC binary options as a scam or ponzi scheme with regular notices about brokerages that are scamming unsuspecting retail customers to creative infographics that outline “How not to fall victim to Binary Options scams”.

Almost weekly, a new investigation is launched in Israel against some familiar names and often some unknown brokerages instigated by foreign regulators with the help of the Israeli Police as well as regulators with new powers.

Recently, FinanceFeeds came across an article in Israeli online news portal Times of Israel that caught our attention with the title:

“Israeli binary options firm inadvertently tries to sell to Canadian fraud investigator”

“Jason Roy couldn’t believe his luck when a salesman from what he later established was an Israeli company, Central Option, phoned him, and illegally tried to persuade him to ‘invest’”

Reading further we see that this was not simply a lead list that was purchased that happened to have his name on it, rather sophisticated cold calling technology used to contact people at random with a prerecorded message asking if the person on the other line wants to hear about an amazing investment opportunity.

Whilst this tactic (cold calling technology) is well known outside of financial services – for example it was pioneered in the early 1990s in the telecommunications industry, we can see how this can be used in the OTC binary options space considering the lack of leads and price to attract customers to signing up, added to the bad press out there.

Albeit a good way around traditional acquisition channels for OTC binary options brokers bypassing high cost advertising, this is a total “no no” considering the persons called are all unqualified investors. Moreover, not even considering many countries have laws against unsolicited phone calls, this goes beyond and above what can be considered good practice in the financial services sector.

Indeed, the entire practice of operating OTC binary options companies is completely illegal in the United States, and solicitation of American customers by such brands has been a moot point for the American authorities – one such case having resulted in a settlement of $11 million to the CFTC by an Israeli OTC binary options company for soliciting American clients.

The frustrating thing is, that most of these shops are operating from Israel. Without talking politics, Israel is a nation that does not particularly want to draw further “bad press” or build a reputation, albeit unfounded, for being the financial scam capital of the world.

What, why, how, who?

As I’m sitting here writing this I cannot help but be a little flabbergasted at the sheer volume of the problem and how one tiny nation can have such a huge impact on a particular industry and in this case for the worst.

How the heck did this happen so quickly? How many shops operate in Israel, who started all this, and what can possibly come next? These are all questions that I ask myself and unfortunately I don’t have answers to all of them.

I remember a time when retail OTC FX was becoming hard and the market was becoming saturated with similar brokers. Binary options was meant to be the next thing. So many of my former colleagues moved onto OTC binary options brokerages and many founded their own brands.

I’ll never forget a conversation I had with an old colleague from Australia. A man in his early 50s with some large investment bank names on his CV was approached by a prominent OTC binary options broker to look at moving into the Australian markets.

At the time, this brokerage was just in its infancy, we are talking 2012; but today it is one of the top five. I won’t mention names as this is not about shaming, however; just over four years ago, everyone was talking about OTC binary options as a money making machine.

Something along the lines of “It is gambling, addictive but its finance so we somehow get away with it. The best thing is you just move the price when you like so can control risk easily; you are in total control” was used to try sell this.

One of the brands in Israel told anther colleague of mine, when asked about how leads are generated and what audience is targeted “We go for people with addictive personalities, those who play poker or cannot stop gambling.”

Most of the good guys in the industry that are still in it today and view the Financial Services as a long term profession, all discounted Binary Options at the time as something that will be “over” overnight.

Years later and there are more Binary Options shops started almost weekly.

Easy entry, easy money, total control

OTC binary options has made its boom (on the brokerage side) by taking the trills of the financial services and removing what would be a complicated entrance into an FX brokerage in regards to costs, regulations, maintenance and the like.

It is sold as an easy entry, easy money, total control type business. The saddest thing is many coming into the business are from the gaming industry or from industries that are totally unrelated. This is purely a bad thing in my opinion due to the fact that the financial services part is viewed as a smokescreen versus the respect it deserves.

I mean who’d like to make a call selling online slot machines versus, “I’m a broker, wear a suit, drive a Ferrari, drink top shelf for lunch, and do what I like. Be like me, trade the markets”…?

Another miss and again in my view a total failure of the industry are the folk selling it. I speak for what we know about the Israeli markets, most are new immigrants from countries like the US, CA, UK and AU; are broke, and need to put food on the table and try claw back a quality of life of what they had back home.

I cannot give exact stats, however; a quick job search for English speakers in Israel and you have Binary Options, Binary Options, Binary Options, FX, some high tech firms in the sales divisions, Binary Options, Binary Options and then some more Binary Options.

It is, no its not, it is, no its not.

OK, this seems an appropriate time to broach it. Firstly, a confession. I personally over the years held the opinion that OTC Binary Options is closer to gambling that it is to trading or financial services by a long shot.

I have often argued my perspective on this matter with regard to the many that have contributed to giving a profession that I take seriously a bad name. Moreover, a country that I have an intimate history with, Israel; a bad name.

Then something happened. In late October last year, we sat in a beautiful office on 499 Park Avenue, New York. This is hands down one of the coolest offices I have been in as, wait for it, the entire palatial building belongs to this particular well known and highly respected institutional derivatives exchange. Here is where the two worlds completely divide. Here begins absolute quality.

Cantor Futures Exchange’s President Rich Jaycobs and Rod Drown, Senior Managing Director of Global Products and Services, were sitting directly opposite us. Two gentlemen that are of the highest caliber have some of the best names on their CVs and a long history in Financial Services.

The two kinds of folk you hope to meet when you enter the very upper echelons one of America’s large institutions. We talked Binary Options. We talked about the future. We talked about what needs to happen to clean it up and why the exchange route is a good route.

At the end of the meeting, despite the East Coast winter having got the better of my voice, I expressed as best I could with multiple frequencies and sounds; “gents, you have officially blown our minds”.

I got up and walked out paused and had another look across the reception area, still in shock at where the high quality, exchange traded binary options industry which spans from institutional to high net worth retail clients in the US has arrived, compared with what would seem the complete opposite side of the spectrum in Tel Aviv.

I looked at Andrew, and had a moment of realization that binary options may have a future and if it is to have any future it MUST be operated like an exchange, regulated and follow rules as do FX brokers.

Secondly, awareness needs to be a priority. Many regulators and lobbyists are pushing to have it blocked, banned and for investors and consumers to be made aware of the risks.

As for the Israeli government and regulator, they are both doing their part to reign in the phenomenon with pretty much banning Binary Options in Israel.

There is also litigation currently happening in Israel initiated by foreign courts and regulators which the Israeli regulators and police are fully cooperating with.

The future may be bright yet.

Binary Options may survive if the OTC sector begins to treat customers as real investors. Without discounting the many unsuspecting investors that have lost hundreds of millions collectively; Binary Options on paper is not a scam nor does it have to harm.

The scam in OTC binary options, if not stopped dead in its tracks is the proliferation within upstart brands of people that don’t take the product seriously and have ill intentions.

When a grandmother gets an unsolicited phone call, presses 1 on her dial pad to be connected to a sales representative to discuss this AMAZING INVESTMENT opportunity only to be repeatedly fleeced knowing that she has absolutely NO CHANCE at winning, learning or heck, investing in the first place is a zero-sum game.

When a brand cares nothing about Know Your Customer (KYC) best practice, won’t disclose risks involved in trading OTC binary options, and or try take a credit card from an unqualified investor on the first call to deposit $100 just to try, they are showing ZERO respect for the individual on the other side of the line, you show zero respect for those that have spent years working in financial services and zero respect for themselves, and contributing to a short lifespan for this entire business.

We would love to know your thoughts.

Featured image compliments to U.S. Securities and Exchange Commission.