BinaryBook sales representative pleads guilty in binary options fraud case

Austin Smith, aka John Ried, has pleaded guilty to one count of conspiracy to commit wire fraud.

As FinanceFeeds has reported, US authorities have widened the scope of their actions against binary options fraudsters, with sales staff of binary options firms and marketing entities associated with these firms also targeted.

On Thursday, March 14, 2019, Austin Smith (a/k/a “John Ried”), whose activities are linked to BinaryBook and Yukom Communications, pleaded guilty to one count of conspiracy to commit wire fraud.

From in or about August 2015 through in or about January 2016, Smith worked as a sales representative or otherwise supervised BinaryBook representatives at Numaris Communications. The latter was an Israel-based business that provided sales and marketing services, including retention services for BinaryBook. Numaris co-ordinated its work with Yukom. In correspondence and other communications, Smith identified himself as an ‘expert trader’ and ‘senior broker’ for BinaryBook.

As per the plea agreement, filed yesterday with the Maryland District Court, the Defendant agrees to plead guilty to a one-count Information, which charges the Defendant with conspiracy to commit wire fraud, in violation of 18 U.S.C. § 1349. The Defendant admits that he is, in fact, guilty of the offense and will so advise the Court.

The elements of the offense to which Smith has agreed to plead guilty are:

That on or about the time alleged in the Information, in the District of Maryland:

- Two or more persons agreed to do something that federal law prohibits, that is, to commit wire fraud, as charged in the Information; and

- The Defendant knew of the conspiracy and willfully joined the conspiracy.

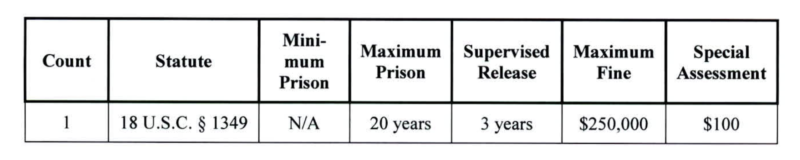

The maximum penalties provided by statute for the offense to which Smith is pleading guilty are as follows:

Under the charges, Smith conspired to commit offenses against the United States, to wit and wire fraud by means of materially false and fraudulent pretenses, representations and promises. It was the purpose of the conspiracy for Smith and other representatives of Yukom, Numaris, BinaryBook, BigOption and other entities to obtain maximum deposit from investors and to take steps to ensure that investors lost money in their accounts – thereby making money for themselves and their brands in the process.

Smith’s case is related to Lee Elbaz’s case. Elbaz, the former CEO of Yukom Communications, is charged with one count of conspiracy to commit wire fraud and three counts of wire fraud. The Indictment alleges that Elbaz participated for over three years (from approximately May 2014 and continuing through approximately June 2017) in a fraudulent scheme involving the sale and marketing of binary options – including as the Chief Executive Officer of Yukom Communications. Yukom was an Israel-based business that provided sales and marketing services, including investor “retention services,” for two internet-based businesses that sold and marketed binary options with the brand names BinaryBook and BigOption.