Bitcoin price volatility prompts IG to review minimum trade size

The broker has scaled the price down by a factor of 100 and has changed the minimum trade size from $/£0.05 per point to $/£5 per point.

The recent surge in Bitcoin prices has prompted electronic trading expert IG Group Holdings plc (LON:IGG) to change the trading conditions for the virtual currency.

The company has scaled the price down by a factor of 100: this means that a price of 293940 is now 2939.4. As a result of this, IG has also reviewed the minimum trade size, which is now $/£5 per point. In the previous pricing, this would have been the equivalent trade size of $/£0.05 per point.

The reason for the change, IG’s team explains, is simply that Bitcoin prices have gone up so steeply since the company started to offer it, and its volatility is at such a level that the trade sizes needed to be adjusted.

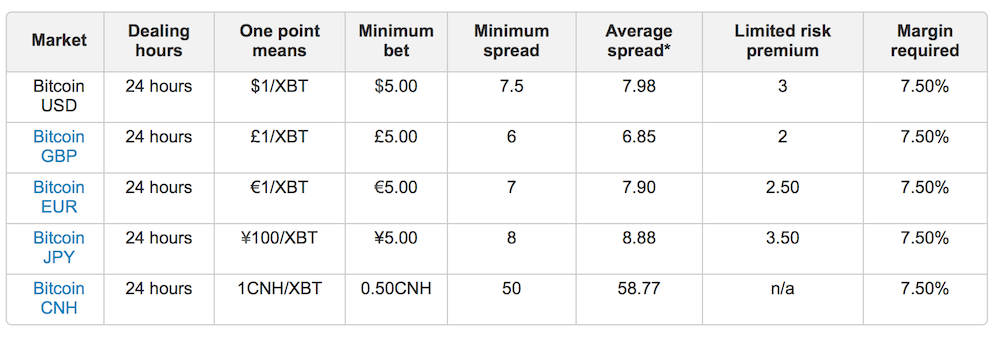

IG offers its clients to deal on Bitcoin currency pairs as CFDs or spread bets: instead of purchasing bitcoins, traders can speculate on their value as a forex pair. IG’s Bitcoin settlement is based on a combination of real-time prices provided directly by bitcoin exchanges.

Bitcoin markets are available from 8am on Sunday through to 10pm on Friday (London time).

To access Bitcoin FX pairs, traders may use the new IG Trading platform and/or the classic platform. In the new IG Trading platform, the Bitcoin instruments can be found under ‘FX’ in the fly-out menu. Also, traders can simply type ‘bitcoin’ in the search bar. On the classic platform, one has to go to ‘forex’ in the finder and, then, select ‘virtual FX’.

The recent Bitcoin price volatility, accompanied by the warmer attitude of regulators towards the crypto-currency, has prompted some online trading companies to enter into the virtual currencies businesses. The latest example comes from Japan, where GMO Internet Inc. (TYO:9449) launched its crypto-currency exchange business GMO-Z.com Coin on May 31, 2017.

However, many are asking what’s underneath the Bitcoin price steep increase. An interesting view has been provided to FinanceFeeds’ readers by Paul Orford, Head of Institutional Sales at AMB Prime. He has drawn a comparison between the current Bitcoin situation and the “Tulip Mania” that engulfed the Netherlands in the 17th century.