Bitcoin To Stock Market Correlation: Why It Happens And How To Make Money

For many years, Bitcoin and other cryptocurrencies were pitched as a mostly non-correlated asset class that investors should add to help de-risk a portfolio heavy in equities. However, since the pandemic, Bitcoin and crypto have increasingly traded lock and step with the stock market.

To some, this is a significant pro, as cryptocurrencies exploded with the same stimulus money that helped keep the stock market climbing. To others, it is a sign that the hedge funds, institutions, and Wall Street types have infiltrated and taken over the world of cryptocurrencies.

In this article, we will examine why this close correlation between the stock market and cryptocurrencies exists today, if it will continue, and how to make money from it.

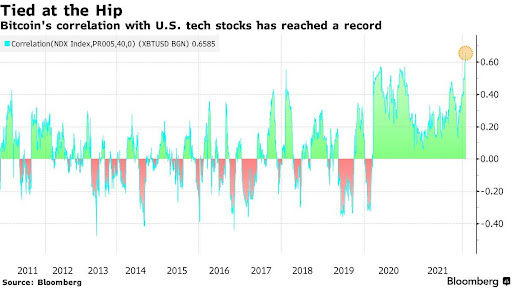

Bitcoin To Stock Market Correlation Reaches All-Time High In 2022

By the beginning of 2022, Bloomberg reported an all-time high in the correlation between Bitcoin and the NDX Index. The NDX is a basket of top US tech stocks. Prior to 2020, the correlation with the stock market was more clearly cyclical, often reaching a significant anti-correlation at repeated intervals.

Why the sudden change in the previous decade-long behavior of anti-correlation, you might wonder? The pandemic forever changed the world and created a rapid change in technological needs on several accounts. On the one hand, cryptocurrencies have become mainstream. Those investing in GameStop or AMC shares also got into crypto. Wall Street has also begun to embrace Bitcoin and Ethereum in a major way. Money has become increasingly digital in the post-pandemic world.

At the same time, inflation makes scarce assets like Bitcoin attractive but is going to put it to the ultimate test. Bitcoin is claimed to be an ideal hedge against inflation, yet the tight correlation with stocks could indicate otherwise. Meanwhile, major tech companies like MicroStrategy, Square, and more have added BTC to their corporate treasury balance sheets with the goal of fighting the situation the Fed has created.

Furthermore, tech companies have since become synonymous with Bitcoin and crypto for one or more reasons. For example, CashApp lets users buy and send BTC along with cash, Robinhood now offers crypto, and Twitter has launched NFT-enabled avatars that connect directly to the Ethereum blockchain. And that is barely scratching the surface of what is out there. Nearly every major brand today has debuted its first attempt at an NFT.

Crypto Is Here To Stay, But Inflation Remains A Risk

It is clear that Bitcoin and the rest of crypto at this point are deeply tied to the tech industry due to several crucial factors. This close relationship will only grow in the future. Shark Tank star and investor Kevin O’Leary ultimately expects cryptocurrencies to become the 12th sector of the stock market and be completely integrated within it.

The crypto market is poised for incredible growth when comparing its tiny few trillion-dollar valuation next to more than $100 trillion in equities. However, if equities perform as they have in past periods of strong inflation rates, and the correlation with the stock market remains, things could become challenging for crypto.

With the Fed raising interest rates to combat high consumer inflation and an energy crisis, the risk appetite that pushed the stock market and crypto to new highs has begun to fade. The Fed might not end up taking quite as strong of a stance as might be necessary, possibly allowing more room for growth in stocks and crypto assets.

Only time will truly tell what the outcome will ultimately be. Currently, the market is bracing for a collapse of a lifetime. A contrarian take would conclude that if the masses expect a massive crash is coming, one more rally for the record books could appear while the market is in disbelief and fearful. If not, or after the rally ends, then a more painful correction and downtrend could follow.

Profit From Market Volatility With PrimeXBT

All this means that markets will keep us guessing for the foreseeable future. No one can predict precisely where Bitcoin is in its market cycle, when the correlation may disappear, or if the entire global economy will crash all at once. These are critical times, and this calls for critical measures.

With Bitcoin and crypto being tightly correlated with stocks still, but such a promising market for future profits, the best position to take is one of total flexibility. Rather than holding Bitcoin or crypto during this high-risk environment, going long or short Bitcoin, Ethereum, or other coins will allow traders to make the most out of the potential opportunity but be agile enough to cut losses and take profit on winners before things begin to correct.

PrimeXBT offers long and short positions on not just a massive list of crypto assets but also stock indices like the NDX, S&P 500, Dow Jones, and other global indices. The crypto list alone stretches across several important sectors like DeFi, GameFi, Metaverse, and more. There are more than one hundred trading instruments in total.

The platform also has gold, silver, oil, natural gas, and a comprehensive list of major, minor, and exotic forex currency pairs. These other traditional trading instruments show a lower or negative correlation with the stock market and, therefore, crypto in its current state.

If, for some reason, the correlation suddenly breaks, PrimeXBT traders can short the stock market while going long crypto, all with the same single account, under the same roof. This powerful margin trading account also links to the Covesting copy trading module, APY-generating yield accounts, and many more features that traders should consider if exposed to crypto or the stock market. With PrimeXBT, you can be ready for anything.