Bitzlato’s Anatoly Legkodymov arrested for catering to “dirty money” on Hydra

“Today’s actions send the clear message: whether you break our laws from China or Europe – or abuse our financial system from a tropical island – you can expect to answer for your crimes inside a United States courtroom.”

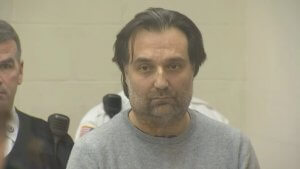

After an investigation by the US Justice Department in close coordination with French law enforcement authorities and the Treasury Department’s FinCEN, Anatoly Legkodymov, founder of crypto exchange was arrested in Miami and charged with processing over $700 million of illicit funds.

The Russian national who resides in Shenzhen, People’s Republic of China, allegedly used Bitzlato to operate a money transmitting business that transported and transmitted illicit funds, thus failing to meet U.S. regulatory safeguards, including anti-money laundering requirements.

Bitzlato was administered by Legkodymov from Miami in 2022 and 2023. The website received substantial traffic from U.S.-based Internet Protocol addresses, including over 250 million such visits in July 2022, which shows that Bitzlato catered to US-based customers.

Bitzlato’s largest counterparty was illicit online marketplace Hydra

Bitzlato is a Hong Kong-registered cryptocurrency exchange that operates globally and which has marketed itself as requiring minimal identification from its users, specifying that “neither selfies nor passports [are] required.” The firm allowed users to provide information belonging to “straw man” registrants.

As a result of these deficient know-your-customer (KYC) procedures, Bitzlato allegedly became a haven for criminal proceeds and funds intended for use in criminal activity.

Bitzlato’s largest counterparty in cryptocurrency transactions was Hydra Market (Hydra), an anonymous, illicit online marketplace for narcotics, stolen financial information, fraudulent identification documents, and money laundering services that was the largest and longest running darknet market in the world.

Hydra users exchanged more than $700 million in cryptocurrency with Bitzlato, either directly or through intermediaries, until Hydra was shuttered by U.S. and German law enforcement in April 2022. Bitzlato also received more than $15 million in ransomware proceeds.

Legkodymov acknowledged Bitzlato’s customers were “crooks”

According to the complaint, Legkodymov and Bitzlato’s other managers were aware that Bitzlato’s accounts were rife with illicit activity and that many of its users were registered under others’ identities.

Legkodymov even used Bitzlato’s internal chat system to write to a colleague that Bitzlato’s users were “known to be crooks,” using others’ identity documents to register their accounts, said the DoJ statement.

The Bitzlato founder was allegedly repeatedly warned by colleagues that Bitzlato’s customer base consisted of “addicts who buy drugs at [] Hydra” and “drug traffickers,” with one senior executive even stressing that Bitzlato should combat drug dealers only “nominally,” to avoid hurting the company’s bottom line.

An internal spreadsheet saved in Bitzlato’s shared management folder encapsulated the company’s view of itself: “Positives: No KYC. . . . Negatives: Dirty money. . . .”

Although Bitzlato claimed not to accept users from the United States, it did substantial business with U.S.-based customers, and its customer service representatives repeatedly advised users that they could transfer funds from U.S. financial institutions. Legkodymov is charged with conducting an unlicensed money transmitting business. If convicted, he faces a maximum penalty of five years in prison.

French authorities, working with Europol and partners in Spain, Portugal, and Cyprus, dismantled Bitzlato’s digital infrastructure, seized Bitzlato’s cryptocurrency, and took other enforcement actions.

FinCEN identified Bitzlato as a “primary money laundering concern” in connection to Russian illicit finance. The order imposes a special measure prohibiting certain transmittals of funds involving Bitzlato by any covered financial institution.

“Bitzlato sold itself to criminals as a no-questions-asked cryptocurrency exchange”

Assistant Director in Charge Michael J. Driscoll of the FBI New York Field Office, stated: “As alleged today, Legkodymov knowingly allowed Bitzlato to become a perceived safe haven for funds used for and resulting from a variety of criminal activities. The FBI and our partners remain steadfast in our commitment to keeping cryptocurrency markets – as with any financial market – free from illicit activity. Today’s action should serve as an example of this commitment as Legkodymov will now face the consequences of his actions in our criminal justice system.”

Deputy Attorney General Lisa O. Monaco, said: “Today the Department of Justice dealt a significant blow to the cryptocrime ecosystem. Overnight, the Department worked with key partners here and abroad to disrupt Bitzlato, the China-based money laundering engine that fueled a high-tech axis of cryptocrime, and to arrest its founder, Russian national Anatoly Legkodymov. Today’s actions send the clear message: whether you break our laws from China or Europe – or abuse our financial system from a tropical island – you can expect to answer for your crimes inside a United States courtroom.”

Assistant Attorney General Kenneth A. Polite, Jr. of the Justice Department’s Criminal Division, commented: “As alleged, the defendant helped operate a cryptocurrency exchange that failed to implement required anti-money laundering safeguards and enabled criminals to profit from their wrongdoing, including ransomware and drug trafficking. The National Cryptocurrency Enforcement Team’s tremendous efforts to disrupt Bitzlato and arrest the defendant demonstrate that we will continue to work with our partners – both foreign and domestic – to combat cryptocurrency-fueled crimes, even if they transcend international borders.”

U.S. Attorney Breon Peace for the Eastern District of New York, added: “Institutions that trade in cryptocurrency are not above the law and their owners are not beyond our reach. As alleged, Bitzlato sold itself to criminals as a no-questions-asked cryptocurrency exchange, and reaped hundreds of millions of dollars’ worth of deposits as a result. The defendant is now paying the price for the malign role that his company played in the cryptocurrency ecosystem.”

Associate Deputy Director Brian Turner of the FBI, said: “The FBI will continue to pursue actors who attempt to mask their criminal activity behind keyboards and use means such as cryptocurrency to evade law enforcement. We, along with our federal and international partners, will work relentlessly to disrupt and dismantle these types of criminal enterprises. Today’s arrest should serve as a reminder the FBI will impose risk and consequences upon those who engage in these activities.”