Borrow money from Interactive Brokers at tiny interest whilst you trade for profit: Exclusive interview from Greenwich on the company’s new solution

Retail customers can now keep a trading account on a long term basis and still have the things that they want to buy right now, as well as settle overpriced loans from banks, or clear a mortgage for next to nothing as Interactive Brokers launches a product that allows clients to have their cake and eat it

Interactive Brokers’ debit Mastercard invites clients to put stock market collateral to work, as it offers industry-low margin loan rates from its omnibus accounts. Clients with Portfolio Margin and Reg-T Accounts can easily calculate and access line of credit to make purchases at lower interest rates

“This is a breakthrough!” – Steven Sanders, Executive Vice President Product Development, Interactive Brokers

Pragmatic retail traders may want to stay invested long-term, especially those who trade with some of the largest, well established retail brokerages in existence. Occasionally, traders and investors are faced with the dilemma of whether to sell stock to pay for an expense, or take out an expensive loan.

This month, FinanceFeeds spoke to Interactive Brokers Executive Vice President for Product Development Steven Sanders about its solution to this conundrum by the introduction of a brand new product. Interactive Brokers, which is publicly listed on the New York Stock Exchange (NYSE:IBKR), and has its global headquarters in Greenwich, Connecticut, has created an integrated financial management account that links your brokerage account to a debit Mastercard to facilitate borrowing and spending at ultra-low rates.

One of Interactive Brokers’ advantageous positions in North America is its vast equity capital, which exceeds $6 billion.

Due in large part to its breadth of product and technological tools, Interactive Brokers continues to expand. As of September 30, the company states that it had 457,000 client accounts, 23% higher than a year ago, although it is worth bearing in mind that this data is likely to be updated as a result of October’s statistics and metrics.

Interactive Brokers attributes its appeal to active traders to breadth of product around the world, sophisticated trading technology and low costs. The company continues to roll out products designed to appeal to these clients.

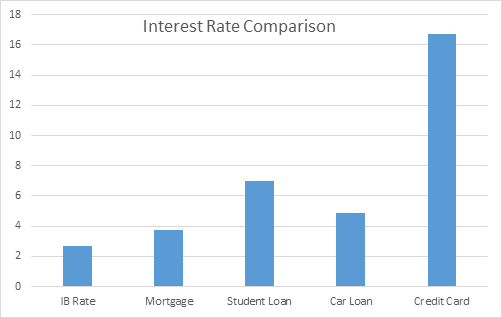

Borrow money from Interactive Brokers at between 1.41% to 2.66% APR.

Mr. Sanders began by explaining to FinanceFeeds that Interactive Brokers will lend money to retail customers who have either Reg-T or Portfolio Margin account, with sufficient buying power, at extremely low rates.

“This new and unique product is not for everybody but for those that need it, it solves a very important conundrum,” explained Mr Sanders.

“We came to the conclusion that lending at low rates to customers would resolve something very important. With many retail brokerages, clients have to transfer money back-and-forth to pay bills. And credit card rates can be 16% or even higher. Plus there is no cost savings apart from marketing incentives, such as special programs where customers get extra air miles or other ancillary services,” said Mr Sanders.

“What we saw as a model for this new service was a client that perhaps had some extra stock, and maybe wanted to borrow money in the same way that they would with a margin loan, but instead of using the money to cover margin, they would borrow from us at the cheapest rate because the loan would be securitized by the stock” – Steven Sanders, Executive Vice President, Product Development, Interactive Brokers

With an Interactive Brokers debit Mastercard, clients can take advantage of the company’s low borrowing costs to borrow for a variety of expenses – such as paying off a mortgage or buying a car.

At Interactive Brokers, the minimum account level for retail investors under the age of 25 is $3,000, whereas for retail investors over the age of 25, a minimum of $10,000 applies.

Clients can apply for the debit card with just $3,000 in their account, which would provide a spending limit equal to those assets. US clients at Interactive Brokers have a mean account balance of $315,000. In North America, it is very commonplace for retail customers to have trading accounts of that value, as the diversified portfolios that cross asset classes make up the majority of America’s trading community.

Industry margin regulations are set by the SEC, Federal Reserve and FINRA. Brokers require their clients to maintain account balances at certain levels in order to hold stock positions. This means that clients may only need 50% of the value of the stock they hold in an account to support the position. The remainder, the client may borrow from the broker.

Many clients have fully paid for securities and have significant buying power should they choose to tap into this line of credit from their broker. For example, a client with $1mm worth of securities in an IB account may have additional buying power of $835,000. The client could tap into some portion of that from IB to make purchases. The cash side of the client’s account goes into deficit, and they pay the prevailing daily rate of interest to IB until the loan is paid off.

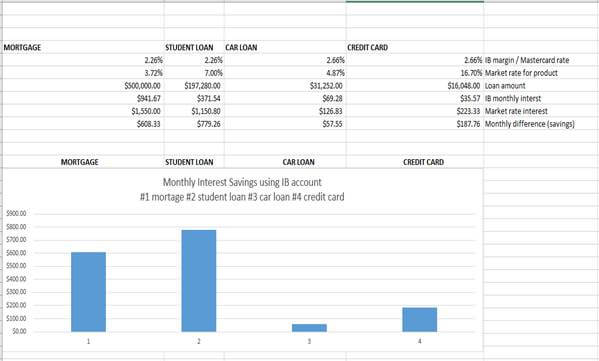

Feasibly, a client could clear a smaller mortgage debt by borrowing from IB. According to Freddie Mac, homeowners currently pay 3.72% on a 30-year $500,000 mortgage balance, for example. According to Interactive Brokers’ website, it would cost 2.26% to fund the same amount. We figure that is a monthly saving of just over $600 in comparison to a payment of $1550.

Interactive Brokers provides a convenient calculator on its website that instantly shows the approximate spending limit based on assets in your IB account for either a Portfolio Margin or Reg-T Margin account. The company also provides a finance cost calculator, which shows the interest rate charge on margin loan balances.

Mr Sanders explained that the debit Mastercard enables IB’s clients to make purchases for most things from a cup of coffee at the local gas station, to airline tickets for global travel and in some cases for charitable donations according to the brokers’ data.

And while some investors might balk at the prospect of levering their accounts to pay off a mortgage, there are substantial potential savings to be had on smaller activities, typically financed on a monthly revolving agreement. Take typical credit card balances as a good example.

According to ValuePenguin, the average household debt for households that carry debt from month to month is $16,048 as of September 2017.

According to Bankrate.com, the average variable credit card interest rate is 16.7% as of October 4, 2017. The impact of exorbitant interest rates becomes extremely clear when you consider that monthly credit card payment of $223.33 compares to a monthly interest charge of $35.57 using stock as collateral in your Interactive Brokers account.

A client with available purchasing power could absorb his credit card debt by borrowing against the collateral value of securities in his Portfolio Margin account held at Interactive Brokers. Borrowing from Interactive Brokers to reduce debt charged at a higher rate of interest typically associated with credit cards could save the client hundreds of dollars in monthly payments. At the same time, his exposure to the market remained the same.

Mr Sanders explained that clients can take out small or large loans. “The limit is based on how much stock you put into the account,” he said.

“Another important aspect is that we have a real time credit manager that tells us what your credit limit is at any time, therefore if a customer goes to a retail store and makes a purchase, the authorization is done against the Interactive Brokers credit manager so the limit is based on any margin rules that are in effect” – Steven Sanders, Executive Vice President, Product Development, Interactive Brokers

“This is a breakthrough!” enthused Mr Sanders. “If you have stock at another broker, why not transfer it over to us, put it in our account, and if you ever have to do any borrowing, then why not guarantee yourself the lowest possible rate.”

The perhaps slightly surprising response from domestic critique, according to Mr Sanders, is that mainstream reporting entities have looked to find where the ‘bolt-on’ packages are such as air miles or loyalty points. This emphasizes how accustomed the general public has become to paying very high rates of interest and considering a rewards club to be valuable when in reality they are paying 15% more interest than is necessary by using traditional credit cards or bank-sourced lending.

Mr. Sanders has held the line that, “My response is that we are not looking to compete in that market. We are looking toward people who have stock, and are always looking to get the lowest possible rate when borrowing, and want everything to be convenient, all in one account with no transfer costs or late payment fees.”

“Just like our commissions and our smart routing technology, our intention is to simply give the best deal,” he said.

FinanceFeeds maintains that this is a very good retention tool that promotes customer loyalty. Instead of witnessing withdrawals, customers may remain with Interactive Brokers for long periods, allow their portfolio to increase in value via trading the multi-asset market, whilst paying for general year-to-year costs at a very low rate.

“The only other method which has similar criteria is a home equity loan, but they are also more expensive, and very bureaucratic, plus those who take that path are risking their home should payments not be met, or should interest rates rise in the general lending marketplace” – Steven Sanders, Executive Vice President, Product Development, Interactive Brokers

“Unsecured borrowers are currently running losses of 5% per year on average, but usually pay off the credit card first, whereas a mortgage is considered more long term. The reason we can give a low rate is because this vehicle is secured by stock. How much stock is in the account is how much lending can be extended. Should a default occur, our risk is covered by either taking the money from the trading account or recovering the stock that has been held as collateral,” said Mr Sanders.

“While there are alternatives such as home equity loans, student loans, or personal loans” reflected Mr Sanders “we lend at 2.66% or less, there are no late fees and it’s easy to use”. Want to charge at Best Buy for a new TV? It gets taken straight from your brokerage account. If you have cash in your account, the cash is used first, or you can borrow at 2.66%. Plus you will never have to make payments, nor incur any late fees” he concluded.