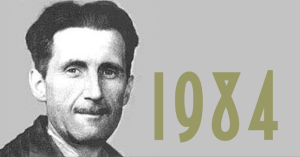

Britain’s banks prepare to share data via Open API: George Orwell’s nightmare, or a fintech app developer’s dream

Is the sharing of data via opensource technology something to relish in that it will provide a massive opportunity for third party app developers and will make the entire financial services ecosystem easy to access via connections to all firms and trans-sector services, or is it an extension of the dystopia which was first coined in […]

Is the sharing of data via opensource technology something to relish in that it will provide a massive opportunity for third party app developers and will make the entire financial services ecosystem easy to access via connections to all firms and trans-sector services, or is it an extension of the dystopia which was first coined in the novel 1984 by George Orwell?

The Treasury has appointed a team of consultants in order to investigate methods in which the banking and financial services industry can make more effective use of data, the result being the team recommending the creation of an ‘Open Banking Standard’ which will govern how customer and bank data can be shared, created and used securely.

The Treasury has appointed a team of consultants in order to investigate methods in which the banking and financial services industry can make more effective use of data, the result being the team recommending the creation of an ‘Open Banking Standard’ which will govern how customer and bank data can be shared, created and used securely.

One method being considered is the creation of an Open API which would aim to make certain portals and sites easier to use by providing the sites with permission to access bank detailed in a controlled and secure way.

Additionally, such an Open API would facilitate a massive opportunity for fintech startups and specialist developers to create third party applications and services, thus allowing the market to diversify and provide ancillary services from trading apps, to integrations between retail FX firms and local bank platforms, along with almost unlimited other permutations.

Whether the implementation of an ‘Open Banking Standard’ would be welcomed universally and spur such development, or whether it will be viewed with scepticism is yet to be seen, George Orwell having highlighted in his dystopian novel some 67 years ago that the intrusive use of ‘telescreens’ and surveillance into every aspect of life by a central government-owned system called ‘Big Brother’ was the source of misery and frustration of its ‘subjects’ whose anodyne lives had become filled with apathy as every aspect of their privacy and ability to maintain their own methodologies had been completely quashed.

This year it is not George Orwell, but rather George Osborne, the Chancellor of the Exchequer, who has encouraged the development of Britain’s financial technology in order that London moves away from its traditional roots and toward that of being a fintech center, as denoted by the rise of ‘Silicon Roundabout’ in Shoreditch, which is home to many new fintech startups ranging from app developers to blockchain technology firms.

As far as integration is concerned, the use of Open API technology most certainly assists the placing of all services within one platform – for example, an FX trading firm can have its trading account automatically integrated within a local bank’s website so that a retail customer can see everything from current accounts to pensions and mortgages as well as his retail FX account on the bank’s platform, without any reference to the FX firm providing the trading environment.

This type of installation is, due to Open API technology, able to be completed by any developer and does not need a team from the FX firm to set it up or maintain it, making white label partnerships very easy to put in place.

Those with white label solutions from existing non-opensource providers require platform licenses, integration of back office and payment systemsm and often permanent support whereas with an Open Banking Standard in place, and Britain’s propensity toward proprietary trading platforms rather than the rigid MT4 due to Britain’s CFD and spread betting environment, the facilitation could be reduced to a fraction of the cost of doing so via a white label which uses a third party provider, and has numerous permutations.

It will be of great interest to see whether this proposal gets passed and becomes a real feature in Britain’s financial ecosystem, or whether security and privacy concerns will stifle it.