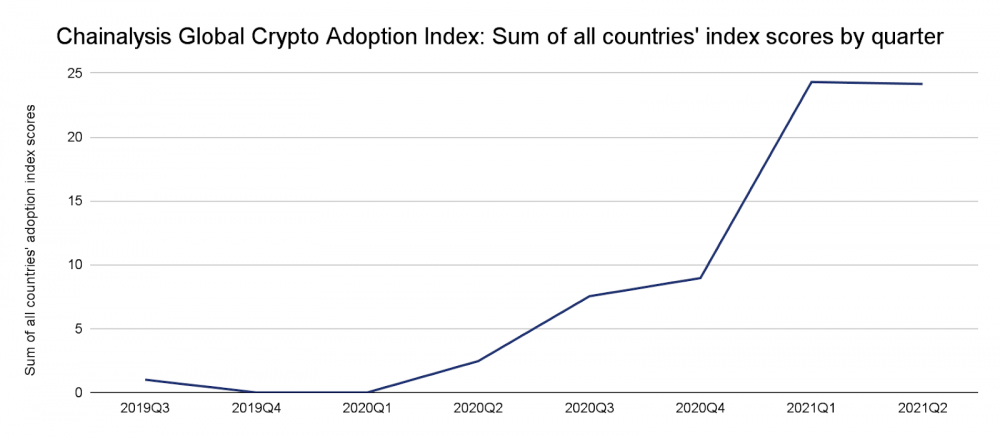

Brokers’ FOMO: Crypto adoption explodes by 2300% since Q3 2019

FOMO – fear of missing out – has truly been passed on to brokerage firms as not only client onboarding but also client retention is at stake.

Chainalysis has released its 2021 Global Crypto Adoption Index, which found that “everyone from banks to institutional investors to everyday consumers is taking notice and incorporating digital assets into their financial strategy”.

Global adoption has grown by over 880% in the last year and grew by over 2300% since Q3 2019, according to the report.

“Our research suggests that reasons for this increased adoption differ around the world — in emerging markets, many turn to cryptocurrency to preserve their savings in the face of currency devaluation, send and receive remittances, and carry out business transactions, while adoption in North America, Western Europe, and Eastern Asia over the last year has been powered largely by institutional investment”, the firm stated.

“In a year when cryptocurrency prices rose dramatically, each region’s respective reasons to embrace the asset class seem to have proven compelling”.

Patterns of cryptocurrency usage, however, vary widely around the world. The report measured adoption across 154 countries and ranked the top 20 countries by objective criteria.

The report points to Vietnam as the leading country in cryptocurrency adoption. It comes as no surprise that most of the countries in the top 20 list rank lower in ranking related to freedoms, both economic and political.

The United States, a leader in blockchain innovation, ranks #8 with its score dropping from last year as regulation by enforcement has become common practice for an industry that calls for clarity in the space.

According to the research, the shrinking of P2P transaction volume in the United States- wihile the rest of the world grows – may reflect increasing professionalization and institutionalization of cryptocurrency trading in the United States, and in China’s case may be related to ongoing government crackdowns on cryptocurrency trading.

China ranked fourth on Chainalysis’s global adoption index 2020. The country ranks much lower now and that may be related to the ongoing government crackdowns on cryptocurrency trading.

How to introduce Crypto to retail investors: Devexperts announces free webinar for Brokers

Cryptocurrency usage in the developed world and in countries that already had substantial adoption is now being driven by the explosive growth of DeFI as well as centralized services, while P2P platforms are driving new adoption in emerging markets.

How much adoption will continue on those platform categories compared to new and emerging models we haven’t seen yet? That’s the million bitcoin question in an industry that is developing much faster than the pace of regulators to control such ecosystem.

“The clear takeaway though is this: Cryptocurrency adoption has skyrocketed in the last twelve months, and the variation in the countries contributing to that show that cryptocurrency is a truly global phenomenon”, the report concluded.