Bulls take a hit as inflation “dazes and confuses” investors, says E*TRADE

“Investors are facing several headwinds when it comes to their portfolios, so it’s not too surprising to see bullishness take a big hit.”

E*TRADE has published the results of its quarterly tracking study of experienced investors, revealing cracks in investors’ pandemic-era bullishness.

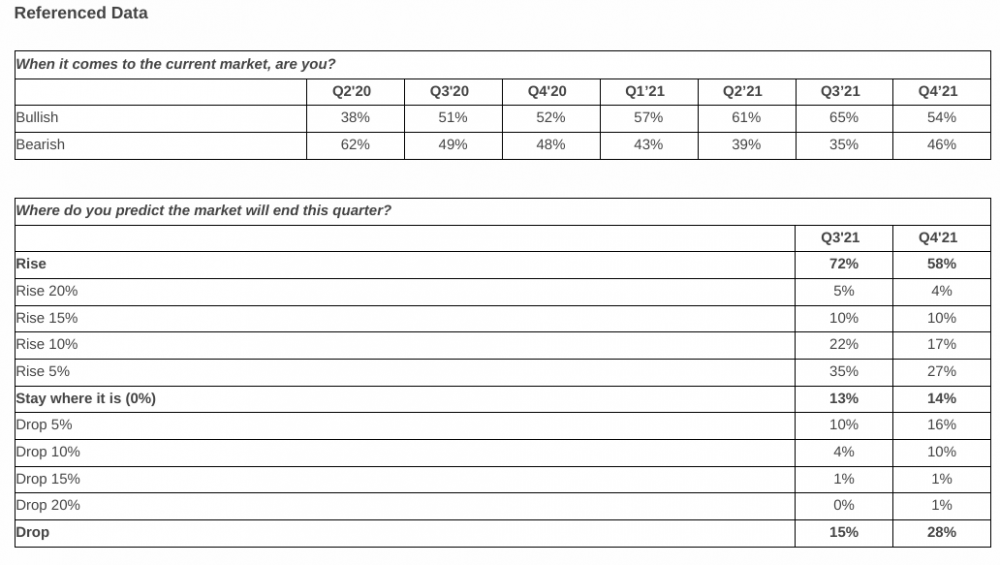

According to the survey conducted by Dynata, investors are facing several headwinds when it comes to their portfolios, which has caused bullish sentiment to decrease, by 11 percentage points to 54%, for the first time since the onset of the pandemic.

The findings also suggest investors are significantly less likely to think the market will end in the green this quarter – down 14 percentage points from last quarter to 58%.

Survey participants chose “Dazed and Confused” as the number one movie title to describe their attitude toward the market, taking the place of “Easy Rider”.

Two-thirds of experienced investors think that volatility will rise over the next quarter and inflation has become their number one concern: over half of investors (52%) are most concerned about inflation when it comes to portfolio risks, followed by market volatility (41%).

Two-thirds of experienced investors think that volatility will rise over the next quarter and inflation has become their number one concern: over half of investors (52%) are most concerned about inflation when it comes to portfolio risks, followed by market volatility (41%).

Mike Loewengart, Managing Director of Investment Strategy at E*TRADE Financial, said: “Investors are facing several headwinds when it comes to their portfolios, so it’s not too surprising to see bullishness take a big hit.

“Many are questioning if inflation is here to stay, supply constraints have weighed heavily on purchasing power, and slowing growth prospects seem to be more of a reality. But investors should keep in mind that volatility is part of a healthy market and preparing for pullbacks is key.”

As to sector opportunities for the fourth quarter of 2021, the historically volatile sector of Energy jumped to the top spot for 44% of investors.

Health care remains an area of focus in the context of the pandemic and booster shots, but also due to emerging growth concerns, which lead investors to shore up on defensive names.

IT saw interest ticking down from Q3, but remains strong overall, with 40% looking toward this ever-popular sector.

The survey was conducted last week among an online US sample of 901 self-directed active investors who manage at least $10,000 in an online brokerage account.

The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 60% male and 40% female, with an even distribution across online brokerages, geographic regions, and age bands.