Canada’s Ombudsman for Banking Services and Investments registers 5% rise in cases in FY 2018

Investment complaints decreased from 351 cases opened in 2017 to 345 in 2018.

Canada’s Ombudsman for Banking Services and Investments (OBSI) has posted its latest newsletter providing some insights into its work during fiscal year 2018.

In 2018, OBSI registered a 5% increase in cases opened, from 721 in 2017 to 760 in 2018. Investment complaints decreased from 351 cases opened in 2017 to 345 in 2018. Banking cases opened continued a multi-year trend, increasing from 370 in 2017 to 415 in 2018, up 12% year over year.

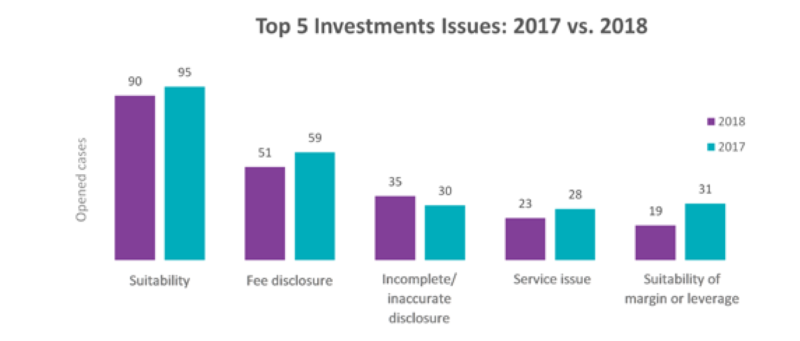

Compared to 2017, there were decreases reported in the top investment issues in 2018 in all categories except incomplete/inaccurate disclosure, which rose 17%. Cases related to suitability of margin or leverage decreased 39% compared to 2017.

Ontario remains the province producing the greatest number of complaints despite a decrease of 6% in cases opened. Cases opened in the Western provinces rose by 19%. Cases in Quebec and the Atlantic provinces were relatively flat. International cases increased to 23 in 2018, up from 10 in 2017.

Let’s recall that, in a Bulletin published in August, OBSI warned that binary options present a systemic risk.

OBSI said it had received numerous complaints from investors who used their credit card to purchase binary options. These investors later disputed credit card charges related to these transactions. They believed that because they did not receive the promised services (such as the ability to withdraw their investment capital) that the issuing credit card company should allow a chargeback or reversal of the charge. The Ombudsman found that the banks involved were not at fault for the failure of the chargeback request because they followed the normal chargeback policies and procedures.

Later, OBSI provided clarification on how it handles credit card chargeback cases. Let’s note that during fiscal year 2018, OBSI registered a 46% rise in issues related to chargebacks compared to 2017.