CAPEX.com signs Ticktoker Zachary King as brand ambassador

Multi-licensed broker CAPEX.com has launched real stock trading in the Middle East on Monday, a move that will see it compete with both established brokerages and high-flying trading apps in the region.

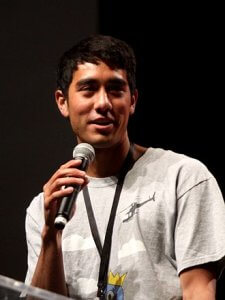

The broker also announced that it has concluded a sponsorship deal with Zachary King who has become its newest brand ambassador. He’s an American internet personality, most known for his “magic vines,” which are six-second videos digitally edited to look as if he is doing magic.

The launch of ‘CAPEX Invest’ product for MENA clients comes amid a broader surge in retail trading, which escalated last year. Additionally, new customers will be given out a free share to under the “Experience the Magic of Trading – Anywhere, Anytime, Anything” concept to promote its new Brand Ambassador, Zach King.

“It’s a real pleasure to announce our collaboration with Zach King. He is a source of inspiration for people worldwide, similar to what we represent for our traders. We truly feel that his creativity, out-of-the-box thinking, and unique style perfectly match our offering here at CAPEX.com. Together, we are set on making trading and investing as easy as possible for everyone,” says Octavian Patrascu, CEO and founder of CAPEX.com.

Zach King, the social media personality known for his popular videos on TikTok and Instagram, added: “I’m thrilled to be working with CAPEX.com and taking part in this magical campaign across the world of investing. It’s been a super fun project so far.”

The development comes hot on the heels of expanding CAPEX.com’s regulatory profile in the MENA region. Most recently, the company received in-principle approval to conduct a full spectrum of virtual assets business in Abu Dhabi.

The new license allows its parent, Key Way Markets Ltd, to bring the CAPEX.com brand closer to clients in the Middle East, with major focus to the United Arab Emirates. The in-principle approval for its crypto business comes to complete the picture as the company already holds the ADGM FSRA license to offer traditional financial services.

As such, the milestone helps broaden the perspectives and business appraisal of the brand as it seeks to cash in on the region’s interest in cryptocurrencies.

The CAPEX.com brand, which received its first license in 2016, is currently providing services across Europe, the Middle East, South Africa, Latin America, and South-East Asia. The company’s regulatory catalogue encompasses licenses from the Cyprus Securities and Exchange Commission, Abu Dhabi Global Market Financial Services Regulatory Authority, and the Financial Sector Conduct Authority in South Africa.

With over 2000 tradeable instruments, the broker is preparing to expand its multi-asset offering by including DeFi and blockchain-based services. CAPEX.com also launched a new product called StoX, which bundles a no-commission trading product with unleveraged fractional CFDs on shares of top US companies.