Caution to traders: Squid Game token can’t be sold and is unlikely to be official

If the market price keeps on rising the way it has been, the virtual Squid Game will be exclusive for rich gamers who don’t have to risk their lives in order to win.

Squid Game, the most popular show on Netflix, has fueled the launch of a few tokens going by the same name. One of them, SQUID, caught the eye of the masses.

The coin started its presale on October 20 and sold out in one second, according to its white paper.

SQUID was launched as the exclusive coin of the crypto play-to-earn platform with the same name. Starting in November, the online tournament follows the show’s plotline with the six rounds of games, but the company already stated “we do not provide deadly consequences apparently!”

The extremely popular Korean-language show is about a deadly tournament of adults playing children’s games in the hopes of winning a big cash prize.

The white paper also lays out an anti-dumping technology that prevents people from selling their coins if certain conditions are not met.

That may be the reason behind the skyrocketing price of SQUID, which is trading above $11 already, from around $0.12 three days ago.

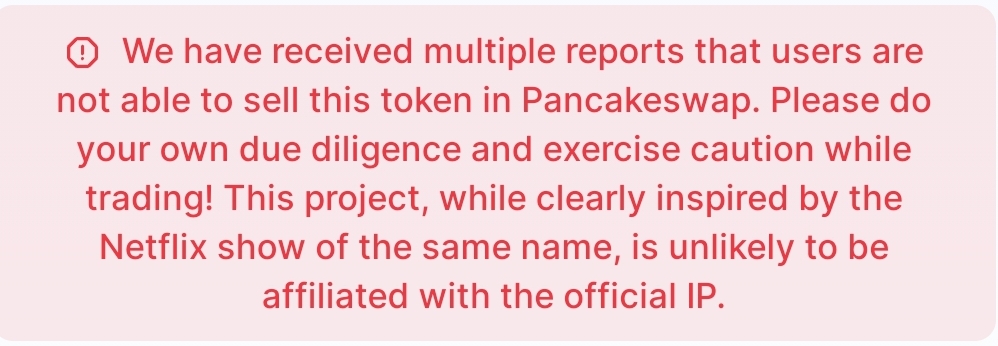

Coinmarketcap has already issued a warning to investors after receiving “multiple reports” that users are not able to sell this token on Pancakeswap.

The virtual simulation of Squid Game has prizes of its own, but unlike the Netflix show, it won’t limit the maximum of the final bonus nor the number of participants.

As to SQUID, there is a preset price in order to participate in each game. It is likely, however, that the game’s developers weren’t expecting the market price to explode to $3 on such short notice.

On top of that, users are required to purchase a custom-made NFT available for sale on their website, featuring characters from the show such as the guards in full-body reddish-pink suits and black masks.

To play in the final game of the tournament, the price is 15,000 SQUID. If the market price keeps on rising the way it has been, the virtual Squid Game will be exclusive for rich gamers who don’t have to risk their lives in order to win.

The winner(s) will earn 90% of the game’s entry fees which will be deposited in the reward pool. The remaining 10% will go to the developers.

SQUID is also available for cryptocurrency staking: investors can put up their holdings as collateral to earn passive income in an offering called Marbles Pools, a reference to the show.