CBA puts the blame for tech outage on data center issue

The problems affecting the operations of NetBank and the CommBank app are said to have stemmed from an issue at one of CBA’s data centers.

Commonwealth Bank of Australia (ASX:CBA) has put the blame for yesterday’s tech outage on problems with one of its data centers.

Pete Steel, Executive General Manager of Digital, Retail Banking Services, has explained:

“We have two data centers that support the app and NetBank. Unfortunately, today, one of them has had an issue and so there’s a lot of demand on one data center.”

Mr Steel has apologized to customers of the bank:

“Yesterday was certainly a tough day and I wanted to apologise to any of our customers who had issues logging on to the CommBank mobile app or to NetBank. Our teams have worked very hard during the night and I am pleased to say we’ve restored all services and we can reassure customers that everything will be working today as they expect.”

In an update issued earlier today, CBA said that services have been fully restored for NetBank and the CommBank app.

Customers of the bank had a rather challenging start of the week, as tech issues plagued online transactions. The issues affect Visa card transactions and payments in NetBank and CommBank app. Clients of the bank complained about being unable to get to their workplaces as they were unable to pay for transportation. The frustration about being unable to pay for a cup of coffee on Monday morning, to pay one’s bills or to conduct business added to the frustration of CBA’s customers.

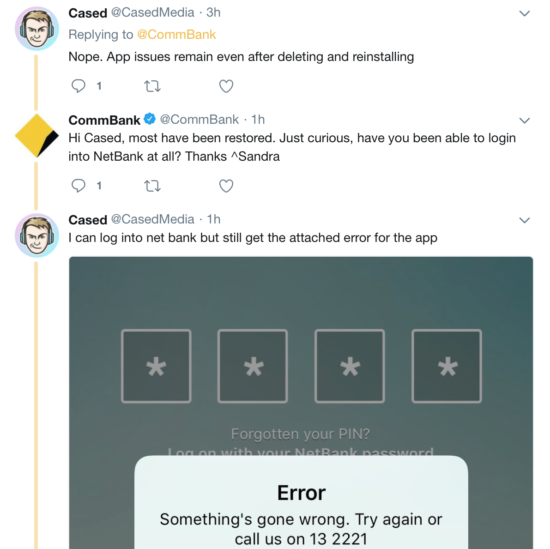

This morning, some customers continue to report issues with the apps. The customer support recommends deleting and reinstalling the app but that does not seem to work in all cases.