Cboe Global Markets registers 5% drop in global FX net revenues in Q1 2019

The decline is primarily due to lower net transaction fees compared with the first quarter of 2018.

Cboe Global Markets, Inc. today announced its financial results for the first quarter of 2019.

Global FX net revenue amounted to $13.9 million in the first three months of 2019, marking a decrease of $0.7 million or 5% from the year-ago quarter. The drop is primarily due to lower net transaction fees compared with the first quarter of 2018. ADNV traded on the Cboe FX platform was $36.5 billion for the quarter, down 12% from last year’s first quarter.

Cboe FX market share increased to 15.8% in the first quarter of 2019, setting a new high and net capture increased $0.16, or 7%, per one million shares traded to $2.61 for first quarter 2019 compared to first quarter 2018.

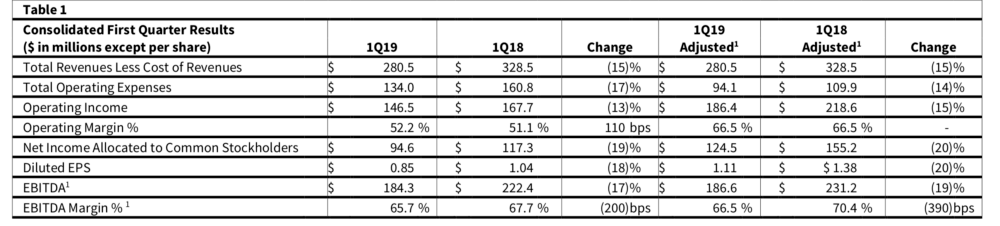

Across all segments, net income allocated to common stockholders fell 19% year-on-year to $94.6 million.

Net revenues were $280.5 million, down 15% from $328.5 million in the prior-year period, primarily due to lower trading volume across all business segments.

Total operating expenses were $134 million versus $160.8 million in the first quarter of 2018. Operating income decreased by 13% to $146.5 million and adjusted operating income decreased by 15% to $186.4 million.

Diluted EPS for the first quarter of 2019 was $0.85. Adjusted diluted EPS was $1.11, down 20% percent compared to 2018’s record first-quarter results. First quarter EPS also includes a charge of $0.06 due to the SEC disapproval of the OCC capital plan, which resulted in the reversal of $8.8 million in OCC dividend revenue recognized in the fourth quarter of 2018.

“We faced challenging market conditions and difficult financial comparisons versus last year’s record first-quarter results,” said Edward T. Tilly, Cboe Global Markets Chairman, President and Chief Executive Officer.

“As we’ve done historically, we used this less volatile period to seed potential future growth in our proprietary index products through increased customer outreach and education efforts. With these efforts, we are confident we are even better positioned to grow our business. We remain confident in the strength of our diversified portfolio of exchanges and the utility of our products, and are embracing the opportunities before us to continue to define markets globally to deliver value to our customers and shareholders,” Mr. Tilly added.