Cboe Global Markets registers 6% Y/Y drop in global FX net revenue in Q4 FY19

The decline reflects lower net transaction fees compared with the fourth quarter of 2018.

Cboe Global Markets, Inc. today reported its financial results for the fourth quarter of 2019, with global FX net revenues staging a drop from the year-ago period.

Global FX net revenue of $12.9 million decreased $0.8 million or 6% from the final quarter of 2018, with the decline primarily due to lower net transaction fees compared with the year-ago quarter.

ADNV traded on the Cboe FX platform was $30.1 billion for the quarter, down 14% from last year’s fourth quarter, partially offset by a 6% increase in net capture per one million dollars traded of $2.80 for fourth quarter 2019 compared to fourth quarter 2018.

Cboe FX had record market share of 16% for the fourth quarter of 2019 compared to 15.3% in last year’s fourth quarter on the back of customer adoption of Cboe’s new full amount product offering.

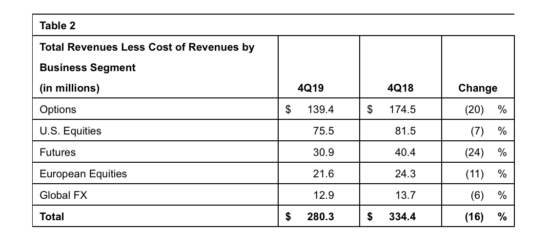

Across all segments, net revenue amounted to $280.3 million in the final quarter of 2019, compared to $334.4 million in the prior-year period, reflecting lower trading volumes across business segments, particularly in options and futures in Cboe’s proprietary index products, including SPX options and VIX options and futures, which had particularly strong trading volume in the fourth quarter of 2018.

Operating income declined 32% from the year-ago quarter to $119.2 million and adjusted operating income decreased by 17% to $184.7 million.

Diluted EPS for the fourth quarter of 2019 was $0.77, down 37% in annual terms. Adjusted diluted EPS was $1.21, down 21% compared to 2018’s fourth-quarter results.

Edward T. Tilly, Cboe Global Markets Chairman, President and Chief Executive Officer, commented:

“Our fourth quarter results reflect lower year-over-year trading volumes industrywide as lower volatility dampened trading, particularly in our suite of proprietary products, which experienced exceptionally strong trading in 2018’s fourth quarter. I am pleased to note, however, that in 2019 we significantly strengthened our foundation for further growth by investing in initiatives aimed at growing our proprietary products; completing our technology migration while delivering on our synergy targets; and launching new initiatives, such as our plan to acquire EuroCCP and launch pan-European derivatives trading and clearing. Additionally, we further enhanced our foundation for growth through this week’s acquisitions of Hanweck, a real-time risk analytics company, and FT Options, a portfolio management platform provider.”

The company provided guidance for the 2020 fiscal year. This guidance, however, does not take into account the company’s planned acquisition of EuroCCP and its investment in launching pan-European trading and clearing.

The company expects capital expenditures to be in the range of $65 to $70 million, which includes expenditures associated with the company’s Chicago headquarters relocation occurring later this year and its trading floor relocation planned for 2021.