Cboe marks 22% Y/Y rise in global FX revenues in Q1 2020

Global FX net revenue amounted to $16.9 million in the first quarter of 2020, up 22% from a year earlier, mainly due to higher net transaction fees.

Cboe Global Markets, Inc. today posted its financial results for the first quarter of 2020.

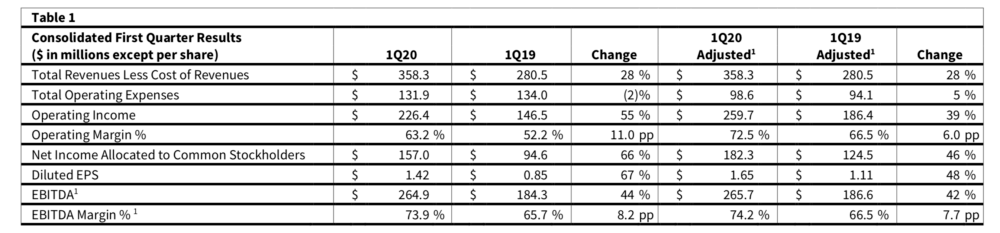

Net revenue for the first three months of 2020 amounted to $358.3 million, up 28% compared to $280.5 million in the prior-year period, reflecting higher trading volumes across each business segment, particularly in options and futures.

Cboe reported global FX net revenue of $16.9 million, up $3.0 million or 22% in annual terms, primarily due to higher net transaction fees. ADNV traded on the Cboe FX platform was $43.3 billion for the quarter, up 19% from last year’s first quarter, and net capture increased 3%.

Cboe FX had market share of 15.7% for the first quarter of 2020 compared to 15.8% in last year’s first quarter.

Total operating expenses were $131.9 million versus $134.0 million in the first quarter of 2019. Adjusted operating expenses reached $98.6 million, up 5% from $94.1 million in the first quarter of 2019. The increase was primarily due to higher compensation and benefits expense, reflecting an increase in incentive-based compensation, which is aligned with the company’s financial and operational performance.

Cboe reported operating income of $226.4 million for the first quarter of 2020, up 55% from the year-ago quarter. Ajusted operating income increased by 39% to $259.7 million as a result of higher net revenue and lower operating expenses.

Net income for the first quarter was $157 million, up massive 66% from a year earlier.

Diluted EPS for the first quarter of 2020 was $1.42, up 67%. Adjusted diluted EPS of $1.65 increased 48% compared to 2019’s first- quarter results and set a new all-time high.

The company paid cash dividends of $40.0 million, or $0.36 per share, during the first quarter of 2020 and utilized $119.5 million to repurchase 1.1 million shares of its common stock under its share repurchase program at an average price of $112.46 per share. As of March 31, 2020, the company had approximately $179.7 million of availability remaining under its existing share repurchase authorizations.

At March 31, 2020, the company had adjusted cash of $137.3 million. Total debt as of March 31, 2020 was $868.1 million.