Cboe registers 5% Y/Y increase in global FX revenues in Q2 2020

The rise was primarily due to higher access and capacity fees and net transaction fees compared with the second quarter of 2019.

Cboe Global Markets, Inc. today reported its financial results for the second quarter of 2020.

Global FX net revenue for the second quarter of 2020 amounted to $13.7 million, up 5%, primarily due to higher access and capacity fees and net transaction fees compared with the second quarter of 2019.

ADNV traded on the Cboe FX platform was $31.8 billion for the quarter, down 2% from last year’s second quarter. The decline in ADNV was offset by a 5% increase in net capture, with net capture per one million dollars traded of $2.77 for second quarter 2020 compared to $2.65 in the second quarter 2019.

Cboe FX market share reached a record high of 16.4% for the quarter compared to 15.2% in the second quarter of 2019.

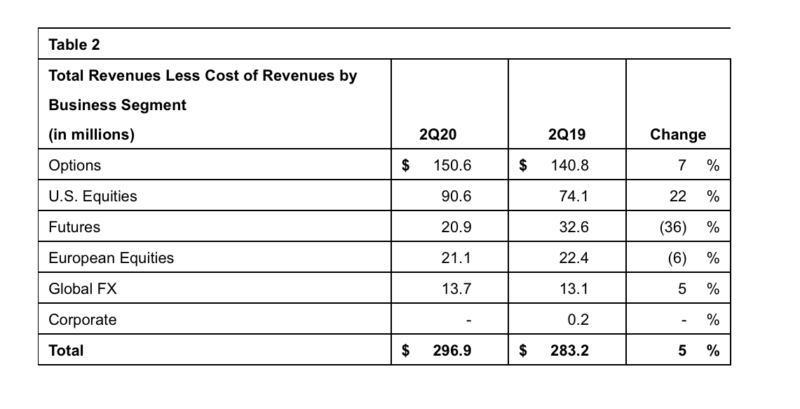

Across all segments, net revenue for the second quarter of 2020 reached $296.9 million, marking an increase of 5% from the result of $283.2 million registered in the prior-year period, reflecting higher market data fees, primarily due to revenue contributed from the acquisitions of Hanweck and FT Options in the first quarter of 2020, and record quarterly trading volumes in U.S. equities and multi-listed options.

Total operating expenses were $135.2 million versus $158.0 million in the second quarter of 2019.

Operating income increased by 29% to $161.7 million and adjusted operating income increased by 12% to $201.1 million as a result of higher net revenue and lower operating expenses.

Diluted EPS for the second quarter of 2020 was $1.03, up 32%. Adjusted diluted EPS of $1.31 increased 16% compared to 2019’s second-quarter results.