CFTC and SEC charge Ellison and Wang as they plead guilty of fraud in FTX case

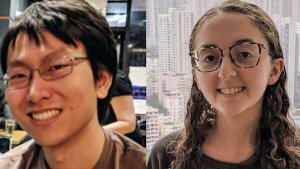

The Commodity Futures Trading Commission and the Securities and Exchange Commission have amended their complaints in the FTX case in order to add fraud charges against Caroline Ellison, Alameda CEO, and Gary Wang, Alameda and FTX Co-Founder.

Besides charging them, the CFTC charges Samuel Bankman-Fried, FTX, and Alameda, for causing the loss of over $8 billion in FTX customer deposits. The SEC charges all these defendants for defrauding equity investors in FTX.

Ellison and Wang both entered guilty pleas to commodities fraud and other charges in a separate, parallel action against them in the Southern District of New York.

Alameda had unlimited credit, quicker execution, no auto-liquidation at FTX

According to the authorities, Gary Wang created features in the code underlying the FTX trading platform that allowed Alameda to maintain an essentially unlimited line of credit on FTX.

FTX executives, including Wang, created other exceptions to FTX’s standard processes that allowed Alameda to have an unfair advantage when transacting on the platform, including quicker execution times and an exemption from the platform’s distinctive auto-liquidation risk management process.

These critical code features and structural exceptions allowed Alameda to secretly and recklessly siphon FTX customer assets from the FTX platform.

Caroline Ellison directed Alameda to use billions of dollars of FTX funds, including FTX customer funds, to trade on other digital asset exchanges and to fund a variety of high-risk digital asset industry investments.

She also made deceptive public statements in her capacity as Alameda’s CEO, including statements about the supposed separation between the operations of Alameda and FTX, in order to facilitate and perpetuate the fraudulent scheme.

Caroline Ellison manipulated the price of FTT

According to the SEC’s complaint, between 2019 and 2022, Ellison, at the direction of Bankman-Fried, furthered the scheme by manipulating the price of FTT, an FTX-issued exchange crypto security token, by purchasing large quantities on the open market to prop up its price.

FTT served as collateral for undisclosed loans by FTX of its customers’ assets to Alameda, a crypto hedge fund owned by Wang and Bankman-Fried and run by Ellison.

The complaint alleges that, by manipulating the price of FTT, Bankman-Fried and Ellison caused the valuation of Alameda’s FTT holdings to be inflated, which in turn caused the value of collateral on Alameda’s balance sheet to be overstated, and misled investors about FTX’s risk exposure.