All change in India: Finance Ministry wants single gold spot exchange

Following on from the Indian authorities move to stem “excessive traders”, the Finance Ministry is now lobbying exchanges to create one gold spot price meaning they all have to agree. Is this another good opportunity for MetaTrader?

As the first business day of 2019 gets underway, massive reforms and restructuring of India’s market infrastructure is becoming a priority, largely centered around exchanges.

Earlier today, FinanceFeeds noted that India’s Securities and Exchange Board of India (SEBI) has begun implementing a game-changing new set of regulatory requirements which the regulator claims is aimed at “taking excessive traders out of the game”, potentially creating a window of opportunity for brokerages to accrue INR traders on MetaTrader 5.

Right now, however, news has just broken about a new initiative by India’s Finance Ministry which has proposed setting up a single gold spot exchange following a meeting with exchanges last week, all of which want to set up individual spot exchanges.

This is another example of the cat being thrown among the pigeons in an already very populous yet complex trading arena.

The Finance Ministry suggested to exchanges that they should work together to create a single spot exchange in which they could all hold stake, according to a source who was present at the meeting. After NSEL went bankrupt following a Rs 5,600-crore ($1.2 billion) scam, there has not been an operational spot exchange in India. Exchanges such as MCX and BSE have sought to set up their own exchanges.

As opposed to a commodity derivatives exchanges, which offer both cash- and delivery-settled contracts, and are used for both hedging and speculation, spot exchanges offer delivery-based mechanism for purchase of commodities. Spot exchanges offer settlement on a T+11 basis.

Given the disjointed nature of Indian business, especially within the capital markets segment, any notion of different exchanges being able to agree on a single spot mechanism may well be a difficult task to achieve effectively.

“The Finance Ministry thinks that a single exchange will be better placed to create a liquid market” a source that was present at the meeting told Indian press today.

Rather similar to the European Tobin Tax, India has its own form of financial transaction levy. Exchanges on their part pitched for the abolition of the commodity transaction tax (CTT) this week. CTT was introduced in Budget 2013 but exchanges maintain that any revenue gains through it are not commensurate to the losses incurred due to unofficial trades it encourages. This demonstrates the need to be competitive in a crowded and less structured environment than the one that exists in traditional stock trading centers such as Europe and North America.

The base of investors in India is very populous with commodities and equity traders, hence these moves are significant and could create a switch by those with less than comfortable faith in India’s government and market structure to get this type of move right.

Thus, multi-asset solutions provided by MetaTrader based brokers may well be a good antidote and therefore should be looked at seriously.

Commodity trading in India has a long history. In fact, commodity trading in India started much before it started in many other countries. However, years of foreign rule, droughts and periods of scarcity and government policies caused the commodity trading in India to diminish.

Commodity trading was restarted in India recently. Today, apart from numerous regional exchanges, India has six national commodity exchanges namely, Multi Commodity Exchange (MCX), National Commodity and Derivatives Exchange (NCDEX), National Multi-Commodity Exchange (NMCE) and Indian Commodity Exchange (ICEX), Universal Commodity Exchange (UCX) and the ACE Derivatives exchange (ACE).

The nature of the business is somewhat different to that of London, Chicago or Sydney, in that the fast pace and constant volatility, plus lots of disorder in the markets creates massively differing methods to be implemented from time to time. Traders therefore are adaptable to change and used to higher risks than those in more stable markets, hence are a good read across for spot FX via exchanges.

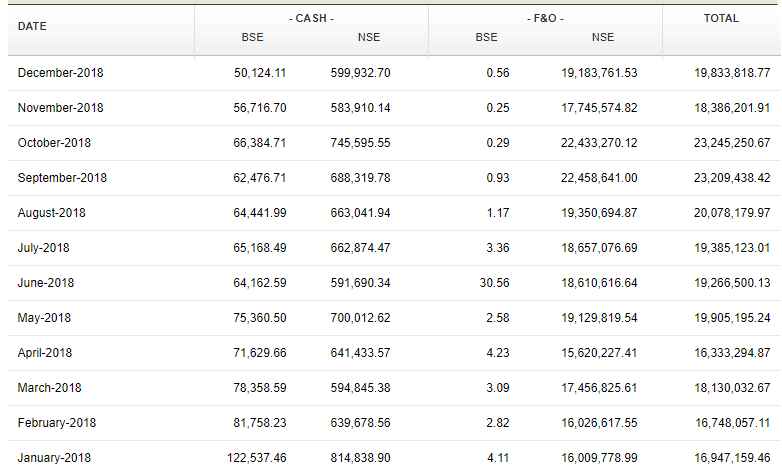

Turnover is vast at Indian exchanges, thus for those with a will to attempt to navigate the extremely complex yet volatile derivatives market, this may be a good opportunity.