China’s FX elite: FinanceFeeds produces exclusive IB symposium in Shanghai with CMC Markets

An exclusive audience of top level Chinese IBs were hosted by FinanceFeeds yesterday in Shanghai. Here is the full report

In all sectors of the OTC derivatives industry, China is at the center of the agenda, it being home to the most structured and largest B2B electronic trading environment in the world, by a very long way.

Vast networks of introducing brokers operate in China, and with FinanceFeeds being the only international FX news and research companyto have a comprehensive commercial presence in the People’s Republic, FinanceFeeds China, our extensive relationships among China’s industry leaders on a national basis is a unique value that we are committed to bringing to the FX industry’s higher level firms.

Yesterday, FinanceFeeds hosted a bespoke IB Symposium in Shanghai, a service which is produced to order, meaning that a brokerage is able to gain an exclusive audience with a minimum of fifty top level Chinese IBs.

IBs in China are instrumental to the industry’s sustainability globally. They are large, well-staffed companies that offer portfolio management, automated trading and asset distribution services to high net worth investors across the second tier development towns and large financial centers of China, the most important region for the retail FX industry in the world.

FinanceFeeds has specialized in researching the FX industry’s continually evolving landscape and business ethos across mainland China for several years, and has built substantial relationships with large introducing brokers that in many cases have in excess of $300 million in assets under management, and whose requirements for execution are to place business with reputable brokerages in well-regulated jurisdictions in Western countries.

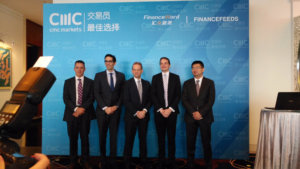

Yesterday, at the Four Seasons Hotel in Shanghai, FinanceFeeds hosted over 60 senior executives of large IBs in the Shanghai area, as an exclusive audience for publicly listed British multinational electronic trading company CMC Markets.

In China, pedigree is absolutely everything, and it is very clear that among factors that are critical, what matters is speed of money transfer in and out of the brokerage, good quality regulation and in that case only the FCA or ASIC will do, security of client funds and where trades are being executed.

Last year was most certainly a year in which the entire prime brokerage sector was subject to a massive amount of evolution in the Western world, largely due to the increasing demand from brokerages for the best possible execution and access to the most accurate pricing and trade processing environment, as well as the counteraction to this, which has manifested itself in the major Tier 1 banks having curtailed the extension of credit to OTC derivatives firms due to their extremely conservative approach to counterparty credit risk.

This has created a situation in which the main Tier 1 banks are now ultra-conservative and are still licking their wounds by selling off retail divisions in their entirety, and restricting how much risk they take on counterparty credit extension to retail brokerages despite their operational leaders understanding the importance and efficiency of Tier 1 counterparty credit extension to the OTC sector.

Chinese IBs and brokerage executives know this very well indeed, and recently FinanceFeeds spoke in front of 400 Chinese FX industry executives in Shanghai, all of whom concurred that a detailed understanding of how brokerage infrastructure works from the top (Tier 1 bank and single dealer platform) down (payment services provision to and from China on a bulk/omnibus basis and retail execution via prime of prime to live markets) was paramount for those using MAM accounts to trade vast client assets and process them to FX firms in Western financial centers.

Two companies with the correct approach to this are Saxo Bank and CMC Markets, both whom have their own proprietary prime of prime solution that is hosted within China and can provide a comprehensive system for Chinese IBs.

CMC Markets has been expanding its presence within the mainland recently, and in October last year, FinanceFeeds was exclusively present at the launch of the company’s new corporate operation in Shanghai, along with CEO and founder Peter Cruddas, having reported its opening and detailed commentary from senior executives in both Chinese and English.

CMC Markets set up its new office in Shanghai to increase its presence in China. As early as 2005, CMC Markets set up its first overseas office in Beijing, and CMC Markets will now set up its second China office in Shanghai’s Pudong New Free Trade Area, hence has a very long standing relationship with Chinese business.

In October last year, Peter Cruddas, CEO and founder of CMC Markets explained “We are coming to China to meet the needs and voices of Chinese customers. Many Chinese customers will choose to use CMC Markets as a method by which to enter the international market to invest, so this entrance into China is a very important opportunity. With CMC Markets 10 Years of growth within this region, in order to better serve the Chinese market, its Asia Pacific office responsible for customer service employs staff of which more than 40% have a Chinese background.”

Hence, as part of FinanceFeeds ethos of bringing the key leaders of Chinese industry to quality Western firms, yesterday’s symposium provided exactly the platform for furthering vital business in China.

In the Asia Pacific region, CMC Markets has ranked very highly in Australia in terms of market share for the third consecutive year, being responsible for the largest number of high net worth customers, and in terms of overall customer satisfaction has always been among the best in the region, which must be consistent with CMC Markets uphold technological innovation is inseparable.

Addressing CMC Markets senior management team at the launch in Shanghai, FinanceFeeds posed the question “How does CMC Markets plan to create the ultimate user experience for the “next generation” of an active trader, and what is CMC Markets operational approach toward serving Chinese institutional clients through platform technology innovation?”

Mr Lewis replied “As early as 1996, when the computer was not so well developed in the domestic environment, we expended a lot of resources in Europe, by way of independent research and development of IT systems and proprietary platforms, and now after a long period of development, the entire system has become very mature. We have long been committed to the development of our ‘Next Generation’ trading system, mainly in order to provide a very tailored and high level of service to our investors, and thee most important work that we do is to ensure that our entire system is ergonomically practical for customers, to provide the services they need.”

Yesterday, Richard Elston, Head of Institutional at CMC Markets, along with Biyi Cheng, Head of Greater China for CMC Markets, David de Juan Saridna, Head of Institutional Sales at CMC Markets, and Andrew Wood, Institutional Business Development Manager for Australia and New Zealand at CMC Markets presented exclusively to over 60 top level IBs, aligning itself with the requirements specific to China’s discerning portfolio managers and large scale providers of FX business on behalf of their clients.

“In the past 10 years, we became the first non-bank overseas financial institutions in Beijing in 2004, with official approval which resulted in the establishment of the Beijing office. Looking back at that time compared to now, it can be said that China’s investment environment has experienced vast changes but investors are also very mature. Investor preference for investment, risk appetite, and selection of varieties of asset class are all factors that have evolved, all of which we need to understand further. So we are approaching this with a learning mentality” said Mr Cheng.

“We as an overseas company operating in China, come to this market with 27 years of commercial expertise, and have also experienced a lot of ups and downs, but also have learned a lot of lessons” said Mr Cheng.

Here is a full montage demonstrating the symposium which took place yesterday.