Clients of Japanese retail FX broker Excite One have to wait for new social trading service

The company apologizes to its clients about making them wait but does not specify a date for the launch of Macaso.

Japanese retail Forex broker Excite One, formerly known as ArenaFX, has earlier today posted a brief notice concerning the planned launch of social trading service Macaso.

The company apologizes to its customers for making them wait for the start of the service, especially after the registration process has been open for a while. However, the wait has to continue, and the broker promises that it will keep its customers informed about the progress of the preparation of Macaso. There is still no specific date for the launch of the service. Excite One has initially indicated that it will be launched “this summer”.

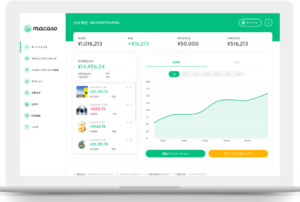

So, what is Macaso? Macaso is a social trading network that enables traders to follow signal providers or to trade at their own discretion. There is no minimum deposit requirement but traders have to make sure their account balance meets margin criteria for the trades they have chosen to enter and the signals they have decided to follow.

So, what is Macaso? Macaso is a social trading network that enables traders to follow signal providers or to trade at their own discretion. There is no minimum deposit requirement but traders have to make sure their account balance meets margin criteria for the trades they have chosen to enter and the signals they have decided to follow.

Macaso users can also implement certain settings, concerning the protection of their account balance.

The broker has promises that the service will start with 100 signal providers that were selected according to rigorous criteria. The signal providers include manual traders and automated programs. Traders are allowed to follow multiple signal providers as long as their accounts can handle it.

In September last year, the broker got a new owner – online services provider Excite Japan Co., Ltd. (TYO:3754). The deal involved the acquisition of 4,702 shares of the outstanding share capital of the broker and is valued at JPY 159.9 million. Following the acquisition, Excite owns a stake of 88.9% in ArenaFX (now known as Excite One).

Nippon RAD Inc. (TYO:4736), the previous owner of the controlling stake in ArenaFX explained back then that the deal will allow it to focus on its core technology operations. It added that it will continue to support ArenaFX with regard to financial technology.