Cloud based ETF highlights developments and opportunities in cloud computing sector

The working environment prior to the restrictions placed on almost every economically active person and business during 2020 is never likely to revert says Anthony Ginsberg, who looks at cloud service providers about which his ETF is most bullish

Anthony Ginsberg, Co-Creator of HAN-GINs Cloud Technology UCITS ETF (SKYY), which is a cloud computing ETF, expects growth in the sector to accelerate and predicts more M&A corporate activity in the cloud space, particularly amongst cloud security firms.

On this point, Mr Ginsberg said: “Due to COVID-19, cloud technology is increasingly embedded into mainstream work-life activities – from digital entertainment/streaming services to video conferencing, social media and remote learning. We expect global cloud spending to hit a new all-time high for the 3rd quarter – as cloud spending globally continues to gain momentum”

“As Work From Home (WFH) behaviours become ingrained amongst tech savvy workers – pre Pandemic work rules are unlikely to revert. Cloud now drives the Internet of Things, from Social Media and Digital Entertainment to Healthcare Innovation (trackers and telemedicine), Future Cars, Cyber Security and AI-Robotics. Many of the larger Cloud players are vertically integrated – offering a variety of cloud services form software to infrastructure and security too” said Mr Ginsberg.

While the US is the most built-out across Cloud, Europe and developing nations are where much of the future growth is expected. Larger cloud players currently have a distinct advantage over smaller Cloud players given their existing global reach. Many cloud themed ETFs focus on US companies but SKYY has global holdings.

“Given the flexibility cloud subscription services affords users and the significant cost savings – versus maintaining onsite hardware – IT budgets are increasingly shifting away from hardware to Cloud. We also expect global cloud spending to hit a new all-time high for the 3rd quarter – as cloud spending globally continues to gain momentum.”

“The large Cloud Infrastructure players will be unable to make huge ground-breaking deals due to the US Election and anti-trust concerns. We expect smaller add-on acquisitions by the Megacap players whose record share prices provide them with a relatively low-cost, cheap currency” said Mr Ginsberg.

The HAN-GINS Cloud Technology UCITS ETF, is a UCITS compliant Cloud computing ETF domiciled in Ireland. It tracks the Solactive Cloud Technology Index, which was specifically developed for this cloud computing ETF.

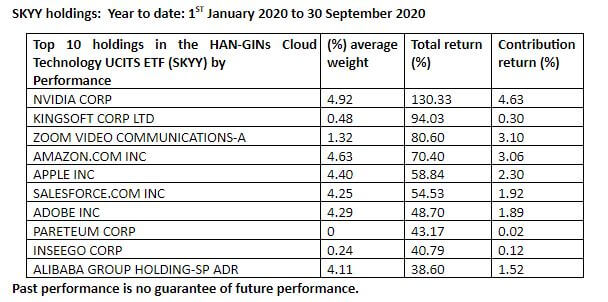

The index seeks to provide exposure to companies active in the field of Cloud computing, such as service providers or producers of equipment or software focused on Cloud computing. The HAN-GINs Cloud Technology UCITS ETF (SKYY) delivered a return of 21.49% over the past 12 months 1 . Past performance is no guarantee of future performance.

Below are five key stocks held by SKYY, which Mr Ginsberg and his team have identified as particularly interesting for investors now, and why they think this. The opinions in this email and reports are of the authors and must not be relied upon as investment advice.

Amazon’s cloud-based unit: Amazon Web Services

AWS now dominates the global Cloud infrastructure market with an approximate 30% market share. It is the primary Cloud host for most global enterprises – with a huge lead over the likes of Microsoft’s Cloud service Azure and Google Cloud. AWS’ revenues rose 31% year-over-year to $21 billion, or 13% of Amazon’s total revenue, in the first half of 2020. More importantly AWS’s profits now represent close to 65% of Amazon’s total operating profit. Its profits are now significantly subsidizing Amazon’s Prime and other lower-margin e-commerce businesses.

Salesforce:

It now owns and operates the world’s largest cloud-based CRM (customer relationship management) software platform. It primarily services private and public enterprises. It controls almost 20% of the market, compared to its European rival SAP which holds a small 5.3% share.Salesforce also now offers various cloud-based e-commerce, marketing, and analytics services. Currently these services help over 150,000 companies to streamline and automate certain tasks, reducing overall dependence on human employees.

Its revenues significantly beat expectations recently – rising 30% year-over-year to $10 billion in the first half of 2020. It showed just how strongly it has benefited from the lockdown and is seen as one of the largest beneficiaries of the new ‘Working From Home’ phenomenon and change in office behavior. It is benefiting from the acceleration of cloud-based CRM, marketing, and e-commerce solutions.

Adobe

Over the past few years using a subscription model online, Adobe has transformed its desktop-based design software into a highly successful subscription-based cloud service. It has subsequently expanded its offering with analytics, advertising, and e-commerce services.

Adobe’s revenues gained 15% year-over-year to $9.4 billion for the first nine months of 2020. It has successfully transformed itself into a cloud company.

Kingsoft

This company is a leading Cloud service provider based in China. Kingsoft operates energy-saving data centers and has branches in the United States, Russia, Singapore and China. It plans to expand its India user-base by 40 million by the end of 2020. It already has over 23 million monthly active users in India – thus is its largest market outside of China. They have a total of 80 million worldwide users. Kingsoft has four subsidiaries: Seasun for video game development, Cheetah Mobile for mobile internet apps, Kingsoft Cloud for cloud storage platforms, and WPS for office software. The company is listed on the Hong Kong stock market.

Nvidia

The company provides groundbreaking computer automation – from advanced computer graphics processors/cards to lasers used by the likes of TESLA. As online gaming expands rapidly due to the lockdowns – demand for its graphics cards has exploded. The company just acquired a leading AI manufacturer based in Cambridge UK called ARM. The $40bn acquisition of ARM makes Nvidia a leader in the use of AI and smartphone technology.

We see this as a critical smartphone deal, transforming Nvidia into a dominant force in the market for smartphones. It’s also a big supplier of technology for a range of other devices – from smart speakers to fitness trackers. Nvidia is a fast-growing tech player best known for making the graphics chips that power videogames for the wildly popular Nintendo Switch. The chips have been in hot demand during the pandemic/lockdown. Nvidia’s chips are also used in big data centers – increasingly in demand as remote work has taken off. It has become the workhorse of artificial-intelligence calculations too – that have grown as more businesses embrace automation. Nvidia generated record sales in the 2nd quarter – its shares have doubled in 2020. With a market capitalization of ~$300bn, Nvidia is now the most valuable U.S. semiconductor company, overtaking Intel Corp., (whose stock has slumped amid production missteps).