CMC Markets Deputy CEO David Fineberg acquires more shares under incentive plan

David Fineberg acquired 306 ordinary shares, at a price of 98.37p each.

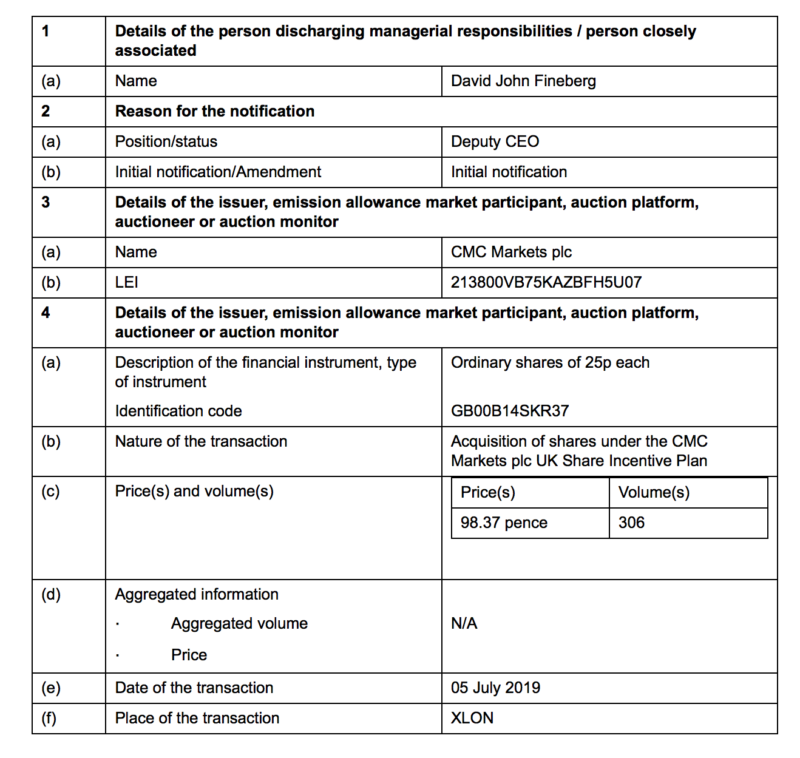

Online trading services provider CMC Markets Plc (LON:CMCX) has announced a transaction in its shares by its Deputy CEO David Fineberg.

As per the report, submitted today, the transaction, which is an acquisition of shares in the broker under the CMC Markets plc UK Share Incentive Plan, took place on July 5, 2019. The volume of ordinary shares acquired is 306, at a price of 98.37p each.

Let’s recall that, about a month ago, David Fineberg also bought shares in the brokerage under the CMC Markets plc UK Share Incentive Plan. That transaction took place on June 5, 2019. The volume of ordinary shares acquired was 332, at a price of 90p each.

In June, CMC Markets posted its final results for the year to end-March 2019, with ESMA product intervention measures affecting earnings but stockbroking business growing. CMC registered profit after tax for the year of £43.8 million, down 88% from a year earlier. The drop was blamed on lower net operating income and the operational gearing in the business.

Stockbroking, however, provided a piece of positive news. The Australian stockbroking business has grown significantly during the year due to the successful implementation of the ANZ Bank white label partnership at the end of H1 2019. This has been the main driver of the 81% increase in revenue to £15.5 million (2018: £8.5 million).