CMC Markets registers steep increase in income in FY2020, marks strong start to FY2021

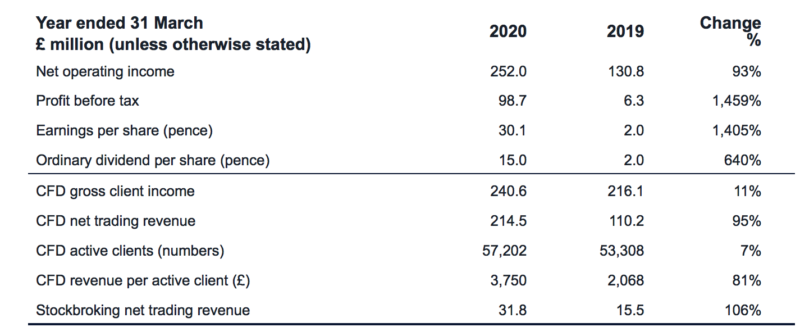

Net operating income for the year to end-March 2020 increased by 93% to £252 million, mainly driven by significantly improved CFD trading revenue.

Online trading services provider CMC Markets Plc (LON:CMCX) today posted its final results for the full year to March 31, 2020, with income staging a steep rise from a year earlier.

Net operating income for the year increased by £121.2 million (93%) to £252 million, mainly fuelled by significantly improved CFD trading revenue performance through higher retention of client income throughout the year following changes to the Group’s risk management strategy and higher gross client income mainly as a result of high market volatility in the latter part of Q4 2020. This was complemented by significant growth in the stockbroking business, through a combination of a full year of revenues from the ANZ Bank white label stockbroking partnership, higher market volatility in Q4 2020 and successful product launches.

CFD active client numbers increased by 3,894 (7%) to 57,202, primarily due to high market volatility relating to the Covid-19 pandemic encouraging dormant clients to reactivate and new clients to onboard onto CMC’s platform.

The increase in CFD net trading revenue has resulted in revenue per active client (“RPC”) increasing by £1,682 (81%) to £3,750.

Gross CFD client income increased by £24.5 million (11%) to £240.6 million, despite 2019 having four months of pre-ESMA trading activity, with increased client numbers and heightened trading as a result of market volatility being the main drivers.

Total operating expenses have increased by £28.2 million (23%) to £151.3 million, mainly as a result of an increase in variable remuneration of £11.4 million due to the significant improvement in financial performance. One-off increases in regulatory fees, volume-driven bank transaction charges and higher bad debt costs also contributed to the year-on-year cost increase.

Profit before tax increased to £98.7 million from £6.3 million, reflecting the high level of operational gearing in the business whereby much of the increase in net operating income directly benefits the bottom line.

CMC also saw strong start to FY2021, as CFD gross client income at the start of the financial year has been around double that during the same period in the prior financial year and client income retention remains strong.

The Group’s significant investment in technology development and infrastructure in its institutional (“B2B”) business is expected to lead to a moderate increase in costs in the coming financial year.

CMC declared final dividend for the year of 12.18 pence per share resulting in a total dividend of 15.03 pence per share, in line with the Group’s dividend policy of distributing 50% of profit after tax. Given the strength of the balance sheet and confidence in strategic delivery, the Board remains committed to paying a total dividend going forward of 50% of profit after tax.