CMC Markets registers steep rise in pre-tax profit in H1 FY2020

Profit before tax jumped 318% year-on-year in the six months to end-September 2019.

Online trading services provider CMC Markets Plc (LON:CMCX) has earlier today posted its financial results for the six-month period to end-September 2019, with operating income and pre-tax profits staging a robust rise from a year earlier.

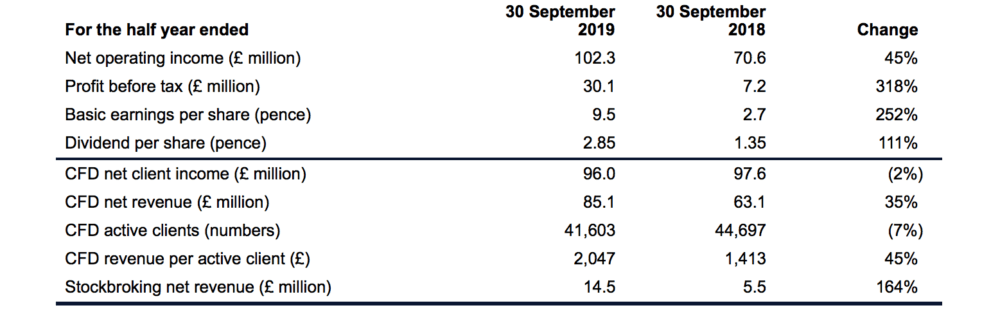

Net operating income for the first half of FY2020 was £102.3 million, up £31.7 million (45%) from the year-ago period. The rise was driven by higher CFD revenue per active client, up 45% to £2,047, as a result of improving retention of CFD client income, and a £9 million (164%) increase in stockbroking net revenue.

Profit before tax jumped 318% year-on-year to £30.1 million.

Alongside its three strategic initiatives, CMC Markets noted that it continues to invest in its proprietary technology platforms to diversify its offering and generate high value through institutional relationships. This has been demonstrated by the success of the ANZ Bank white label partnership which has generated £10 million net revenue in H1 2020.

In terms of institutional offering, the broker continues to focus on the development of existing and new relationships along with development of the product and technology offering.

Across regions, CFD net client income from UK clients decreased by 6%, falling to £33.3 million in the first half of FY2020. Active client numbers in the UK were down 16% to 9,259 (H1 2019: 11,083) mainly as a result of clients who stopped trading in H1 2019 as a result of ESMA regulatory change and lower client acquisition with marketing spend reduced whilst new approaches were tested and optimised.

In Europe, active client numbers were 17% lower than prior year as a result of clients who stopped trading in H1 2019 as a result of ESMA regulatory change a lower marketing spend across the region. The decrease in active clients was driven by the ESMA Retail client base.

CFD net client income was 28% lower across Europe at £16.5 million (H1 2019: £22.8 million), driven by ESMA leverage restrictions that came into effect part way through the prior period.

CMC Markets’ APAC and Canada businesses delivered strong results. CFD net client income increased 17% to £46.2 million (H1 2019: £39.4 million), with the prior year containing a particularly subdued Q2, and due to clients trading a higher proportion of high spread asset classes, such as commodities, in light of market events. Active client numbers increased by 9% to 18,479 (H1 2019: 16,997), with strong growth across the majority of offices in the region.

In terms of full-year outlook, the Board forecasts that net operating income will be in excess of £180 million. CMC Markets continues to expect 2020 operating expenses excluding variable remuneration to be moderately higher year-on-year, with H2 2020 operating expenses excluding variable remuneration to be broadly in line with H1 2020.

The Group continues to invest in technology and people in both the CFD and stockbroking businesses which present great opportunities to deliver long-term value for shareholders.