Coinbase to launch new platform outside United States

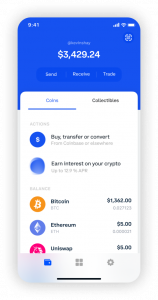

Cryptocurrency exchange Coinbase is reportedly planning to launch a new platform overseas as part of an aggressive expansion outside the United States.

According to a Bloomberg report, the US crypto giant is already in conversation with international clients, investment firms and market makers about those plans.

However, the nature of Coinbase’s overseas operations, or where it would be located, remains unclear. But the exchange already has an active presence in the UK, Ireland, Germany, Spain, Italy, France, the Netherlands and Switzerland.

The American exchange is looking to international markets to drive growth amid fears of a looming clampdown on crypto businesses in the US. Coinbase is also facing some banking troubles after it revealed that about $240 million in corporate cash balance are stuck with the New York-based lender Signature Bank.

That said, Coinbase could be racing offshore to keep pace with its rivals, which are gaining significant traction in territories outside the US. While Coinbase is the biggest crypto exchange in the United States, it’s facing intense competition from players like Binance.

Alongside its US authorisation, Coinbase also holds licenses from Italy, the Netherlands, Ireland and Germany, as well as the UK Financial Conduct Authority. Additional registrations or license applications are in progress in several major markets, in compliance with local regulations.

Earlier this month, Coinbase updated its retail platform in Singapore to reflect a new strategic banking partnership with Standard Chartered that enables customers to move funds to and from accounts via local banks.

Coinbase customers in Singapore now can easily cash in or cash out of their exchange accounts using bank transfers for free. The move provides users with more flexibility and control over their assets as they were previously forced to use debit or credit cards to transact with Coinbase.

Hassan Ahmed, CEO of Coinbase Singapore and the exchanges’ regional director said the Southeast Asia is a “crypto-forward region with a lot of demand for holding and using crypto in markets such as the Philippines and Indonesia, as well as a hotbed of innovation for trends like Web3 gaming such as Vietnam”.