Compagnie Financière Tradition marks rise in profits in 2019

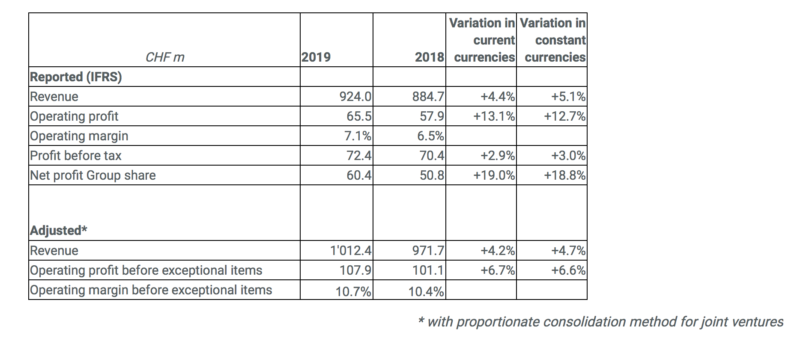

Consolidated net profit amounted to CHF 64.3 million, with a Group share of CHF 60.4 million against CHF 50.8 million in 2018, an increase of 18.8% at constant exchange rates.

Compagnie Financière Tradition, an interdealer broker in over-the-counter financial and commodity related products, today published its financial results for 2019, with the report revealing higher revenues and profits.

The Group notes that its activity grew in 2019 compared with the preceding year, in a relatively changing market environment. Following a slight growth in the first half, activity increased strongly over the summer period to return to balance in the last months of the financial year. The interdealer broking business (IDB) benefited from the recruitment efforts in specialised brokers to reinforce the Group’s presence in a number of regions and asset classes.

In 2019, Group’s adjusted consolidated revenue reached CHF 1,012.4 million compared with CHF 971.7 million in 2018. This translates into a rise of 4.2% at current exchange rates, or 4.7% in constant currencies. Adjusted revenue from IDB business rose 5.0% in constant currencies to CHF 975.7 million while the Forex trading business for retail investors in Japan, Gaitame.com, was slightly down 2.7% to CHF 36.7 million.

Reported operating profit for the year was up 12.7% in constant currencies to CHF 65.3 million compared with CHF 57.9 million in 2018, for an operating margin of 7.1% and 6.5% respectively.

Net financial expense was CHF 11 million for 2019 compared with CHF 5.1 million in 2018. Net foreign exchange results due to exchange rate fluctuations negatively impacted the Group’s financial income and represented a loss of CHF 1.7 million for the year against a gain of CHF 0.6 million in 2018. Interest expense on bank borrowings and bonds, net of interest income from short-term cash investments, totalled CHF 6.4 million against CHF 5.1 million in the previous year, following the placement of a new bond in July. Following the adoption of IFRS 16 Leases on 1 January 2019, an additional interest expense of CHF 2.9 million was recognised on lease liabilities in 2019.

The share in the results of associates and joint ventures was CHF 17.9 million, slightly up from CHF 17.5 million in 2018, thanks to the Group’s good performance in Mainland China.

Profit before tax was CHF 72.4 million compared with CHF 70.3 million in 2018.

Consolidated net profit was CHF 64.3 million compared with CHF 55 million in 2018 with a Group share of CHF 60.4 million against CHF 50.8 million in 2018, an increase of 18.8% at constant exchange rates.

At the Annual General Meeting to be held on May 19, 2020, the Board will be seeking shareholders’ approval to pay a cash dividend of CHF 5.0 per share (yield of 5.0%). In addition, an exceptional distribution of treasury shares will also be proposed with one share distributed for each 50 shares held (yield of 2.0%).