Compagnie Financière Tradition registers steep rise in net profit in H1 2020

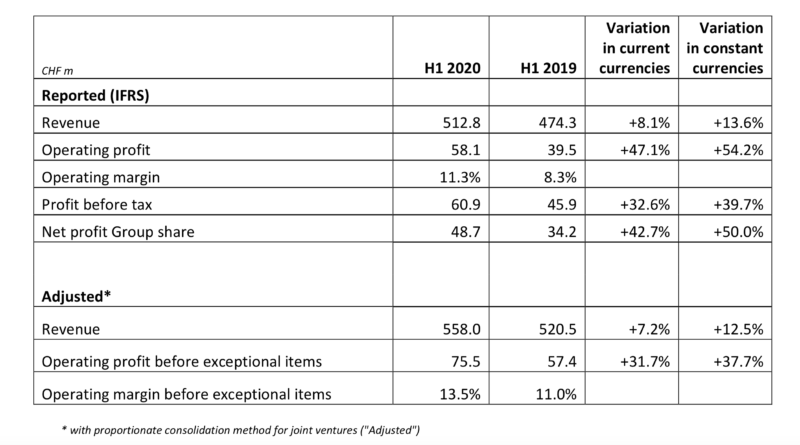

Net profit Group share amounted to CHF 48.7 million in the first six months of 2020, up 50% from a year earlier in constant currencies.

Compagnie Financière Tradition today posted its financial report for the first half of 2020, revealing a set of solid metrics.

Consolidated net profit was CHF 51.5 million compared with CHF 36.8 million in the first half of 2019 with a Group share of CHF 48.7 million against CHF 34.2 million in 2019, an increase of 50% at constant exchange rates.

The revenue results were in line with those reported in an update provided by the company in July.

Adjusted consolidated revenue for the first six months of 2020 reached CHF 558 million compared with CHF 520.5 million in the first half of 2019, a rise of 7.2% at current exchange rates, or 12.5% in constant currencies. Adjusted revenue from IDB business rose 12.8% in constant currencies to CHF 537.7 million while the Forex trading business for retail investors in Japan, Gaitame.com, was up 5.9% to CHF 20.3 million.

Adjusted operating profit before exceptional items was CHF 75.5 million against CHF 57.4 million in the first half of 2019, a rise of 37.7% in constant currencies for an operating margin of 13.5% and 11.0% respectively.

Exceptional costs represented CHF 5.6 million against CHF 6.9 million in the previous period.

The Group maintained its focus on a sound balance sheet with a strong capital position while keeping a low level of intangible assets and a strong net cash position. Before deduction of treasury shares of CHF 17.4 million, consolidated equity amounted to CHF 416.6 million at 30 June 2020 with adjusted cash of CHF 222.9 million, including Group share of net cash held by joint ventures.

At 30 June 2020, consolidated equity stood at CHF 399.2 million (31 December 2019: CHF 416.5m) of which CHF 378.5 million was attributable to shareholders of the parent (31 December 2019: CHF 396.9m). Total adjusted cash, including financial assets at fair value, net of financial debt, was CHF 119.5 million at 30 June 2020 against CHF 77.4 million at 31 December 2019.

After a good first-half performance compared with the previous year, the Group experienced a slowdown in activity in August.