Compensation of Interactive Brokers’ CEO Milan Galik for 2019 tops $8.3m

The annual compensation of Mr Galik includes a bonus of $2.5 million, stock awards of $5.4 million, as well as a salary of $465,000.

Online trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has submitted a proxy statement at the Securities and Exchange Commission (SEC) regarding its 2020 Annual Meeting of Stockholders to be held on Thursday, April 23, 2020 at 9:30 a.m. Eastern Time.

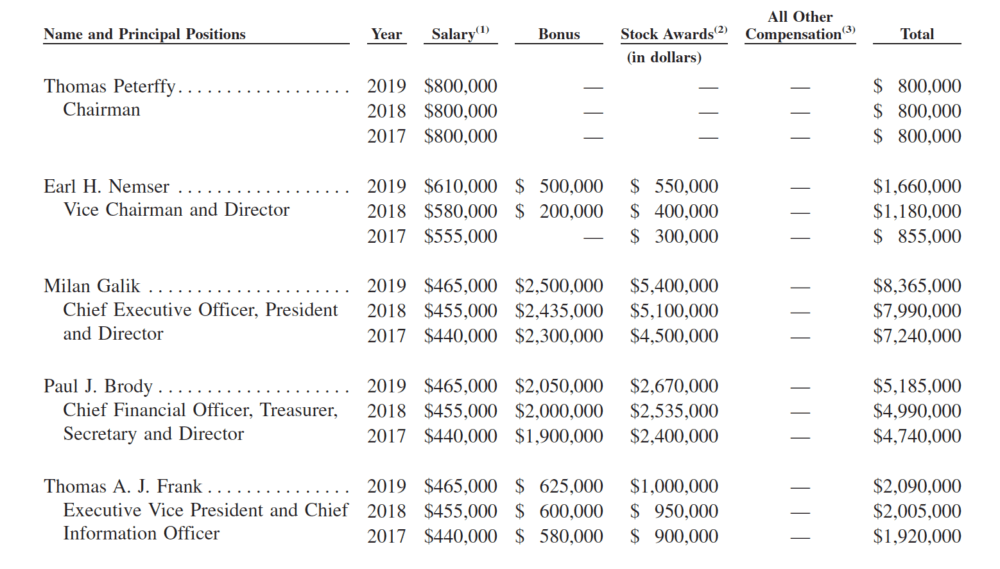

The document includes information on the pay of the executives of the brokerage for 2019. The annual compensation of Interactive Brokers’ CEO Milan Galik for 2019 tops $8.3 million.

As required by Section 953(b) of the Dodd-Frank Act, the company is providing information about the relationship of the annual total compensation of its Chief Executive Officer and President, Milan Galik, and the annual total compensation of its median employee. For the year ended December 31, 2019:

- The median of the annual total compensation of all employees of the Company (other than the CEO and President) was $88,028;

- The annual total compensation of the Chief Executive Officer and President was $8,365,000. The annual compensation for Mr Galik includes a bonus of $2.5 million, stock awards of $5.4 million, as well as a salary of $465,000.

- Based on this information, the ratio of the annual total compensation of Interactive Brokers’ Chief Executive Officer and President to the median employee was 95 to 1.

Interactive Brokers explains that Messrs. Milan Galik and Paul J. Brody and Dr. Thomas A. J. Frank, the Company’s Executive Vice President and Chief Information Officer, have historically been compensated in accordance with the policies under ‘‘Setting Executive Compensation’’ with a mixture of base salary, cash bonus and stock awards under the Stock Incentive Plan. Their 2019 base salary was $465,000, and each received an individual performance-based bonus.

In addition to performance evaluations, consideration was given to the benefits derived from each individual’s existing ownership of membership interests in Holdings. Messrs. Galik and Brody and Dr. Frank received stock awards under the Stock Incentive Plan valued at $5,400,000, $2,670,000 and $1,000,000, respectively, for the year ended December 31, 2019.

The Compensation Committee considered that Milan Galik in his role as President and as newly appointed Chief Executive Officer substantially expanded his key role in the management of the Company over the execution of its strategy and in the ongoing development of software and systems for the electronic brokerage platform, driving the growth of the business.

Mr. Galik’s performance and contribution to the achievement of the Company’s financial goals, as well as his role as Chief Executive Officer and President, merited a higher bonus in 2019 than the other executive officers of the Company, according to the Committee.

Milan Galik joined Interactive in 1990 as a software developer and has served as President of the Company and IBG LLC since October 2014 and as Chief Executive Officer since September 2019. Mr Galik served as Senior Vice President, Software Development of IBG LLC from October 2003 to October 2014. In addition, he has served as Vice President of Timber Hill LLC since April 1998 and serves as a member of the board of directors of the Boston Options Exchange.

Mr Galik received a Master of Science degree in electrical engineering from the Technical University of Budapest in 1990.