Complaints about Forex platforms remain a problem for New Zealand’s FDRS

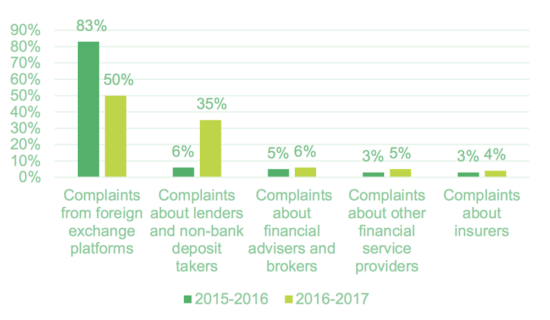

Complaints about Forex platforms accounted for 50% of all complaints received by New Zealand’s Financial Dispute Resolution Service in 2016/17.

Complaints about Forex platforms continue to present an issue for New Zealand’s Financial Dispute Resolution Service, according to its report for the 2016/17 financial year.

There were 236 new complaints registered with FDRS in 2016/17, with the number of Forex complaints accounting for 50% of the total, or 118 complaints. Although the number of FX complaints was lower than in the preceding year, it still represents a high proportion of the total.

Most of the complaints the FDRS received were about foreign exchange platform providers failing to follow instructions, the report elaborates. In particular, these complaints were about lack of response to customer requests to reimburse investments. This has been a complaint trend for three years now, although the numbers of complaints the FDRS has seen over the last year are greatly reduced from previous years.

The bulk of these complaints come from overseas and are about transactions that did not occur in New Zealand. However, because the Forex platform provider is validly registered on the New Zealand Financial Services Provider Register, this triggers the requirement that it be part of a dispute resolution scheme.

The territorial scope of financial service has been a problematic aspect of the Financial Service Provider Act. As part of its review of the Act and the Financial Service Provider Act, the Ministry for Business, Innovation and Employment (MBIE) identified that businesses should be required to have a stronger connection to New Zealand in order to register on the Financial Services Providers Register.

The report does not mention anything about binary options, which have recently got into the focus of the Financial Markets Authority (FMA). The regulator has confirmed that the new requirements for companies offering short-duration derivative products, including binary options, in New Zealand will come into effect on December 1, 2017.

“From December 2017, any company making regulated offers of short-duration derivative products to New Zealanders settling within three days, whether based here or abroad, will require a licence. All currently unlicensed providers must have applied for a licence by 1 August 2017”, the regulator has warned.