Confidence of retail investments sector in FCA suffers

Excessive regulation and the FCA’s “focus on the wrong things” are among the factors for the lack of confidence of many firms in the regulator.

The UK Financial Conduct Authority (FCA) has gotten some assessment from the firms it regulates and although the overall picture is positive, retail investment firms do not confirm to have high confidence in the regulator and its abilities to achieve its goals. If we had been allowed to talk in sentimental terms, we could have said that the retail investment firms hate the FCA. But interpreting the data in more neutral terms, we can safely say that the retail investments sector appears to show the tiniest approval of pretty much any aspect of the FCA’s work, be it enforcement or preparation for Brexit.

Let’s get to the numbers.

This year the FCA and FCA Practitioner Panel have once again carried out a joint survey of regulated firms to monitor the industry’s perception of the regulator and to what extent it is meeting its objectives. The joint survey was conducted by Kantar Public on behalf of the FCA and the Panel. Fieldwork took place between January and March 2018. In total, 2,613 firms completed the survey, constituting a response rate of 26%.

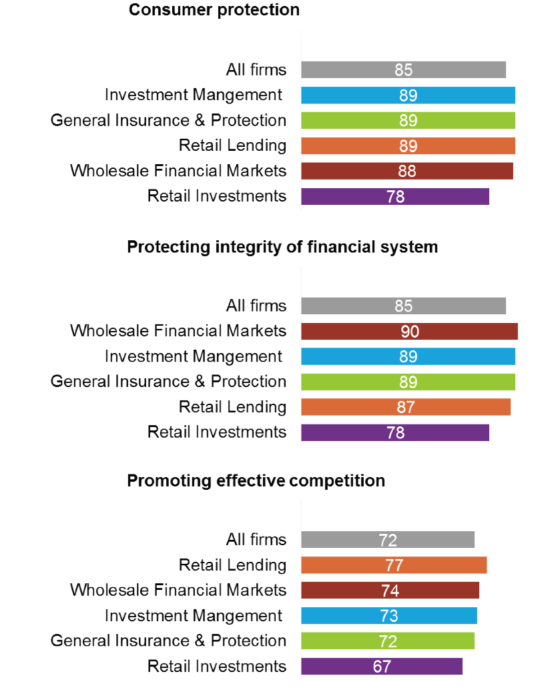

Over the last year, there has been an improvement in the perception of the FCA’s performance against all three of its operational objectives (consumer protection; protecting the integrity of the financial system; promoting effective competition). But this is where the positive news ends, as the retail investments sector offers a slightly different assessment.

For instance, the vast majority of firms (86%) were confident that the FCA was delivering on its strategic objective of ensuring financial markets function well. Levels of confidence were slightly lower in the Retail Investments sector (81%).

Across all objectives, the proportion of firms reporting higher levels of confidence was lower among the Retail Investments and Retail Banking sectors.

- Consumer protection – 78% of firms in the Retail Investments sector were confident compared with 85% of firms overall;

- Protecting integrity of the financial system – 78% of firms in the Retail Investments sector were confident compared with 85% of firms overall;

- Promoting effective competition – 67% of firms in the Retail Investments sector were confident compared with 72% of firms overall.

Firms who reported lower levels of confidence in the FCA’s ability to meet its objectives were asked to describe their reasons for a lack of confidence. The most common reasons given by firms were: large firms have an unfair advantage over small firms (cited by 31% of firms who reported low levels of confidence), excessive regulation (31%) increased costs (15%) and the FCA focusing on the wrong things (13%).

Perceptions of the effectiveness of the FCA were lower in the Retail Investments sector (6.7) and highest among Retail Lending sector firms (7.6).

Trust levels across the different sectors are broadly the same. Retail Investment firms were the least likely to report an increase in trust (13%).

Furthermore, just three in ten firms (31%) agreed that the FCA acts proportionately, so that the costs imposed on firms in their sector are proportionate to the benefits gained by the sector, with 38% of firms saying that they disagreed with this statement. This appears to be a particular concern in the Retail Investment sector (surprise! – Ed.). Half of the firms in this sector (51%) disagreed with this statement, a significantly higher level of disagreement than firms in other sectors.

In all sectors apart from Retail Investments, three quarters of firms agreed that FCA enforcement action in their sector(s) is effective at reinforcing the FCA’s expectations. Firms in the Retail Investment sector were less likely to agree, with two thirds (67%) agreeing.

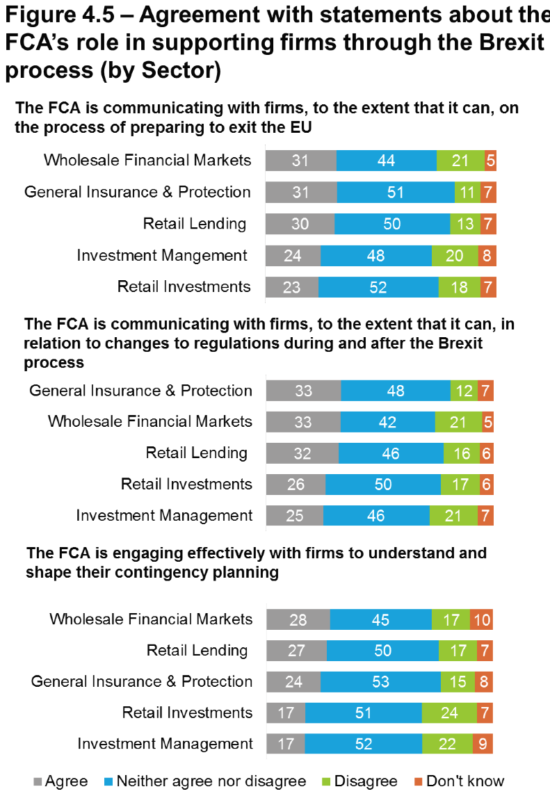

The support that the FCA says it is offering to firms throughout the Brexit process was not quite appreciated by retail investment firms either. Firms in the Investment Management and Retail Investments sectors are invariably the least likely to agree that the FCA is performing well in terms of communicating with and supporting firms through the Brexit process.

All firms were provided with an opportunity to express what they felt the FCA should be doing ahead of the UK’s withdrawal from the EU. Ensuring clear and regular communication with firms was cited as a priority by 14% of firms, while 13% of firms would like the FCA to communicate the effect that leaving the EU will have. Just under one in ten firms (9%) commented that it was too early to say what the FCA should be doing in this area.

The analysis of the findings has identified a number of areas for improvement which the FCA promises it will address over the coming year. These include transparency of regulation and more forward-looking regulation.