Consolidation of capital of Bitcoin ATM aspirer Stargroup is complete

Securities in Stargroup have been suspended from official quotation on ASX since October 2017.

The Deed Administrators of Australian financial technology company Stargroup Ltd, which is known for its efforts to develop Bitcoin ATMs, have posted a brief announcement on the ASX.

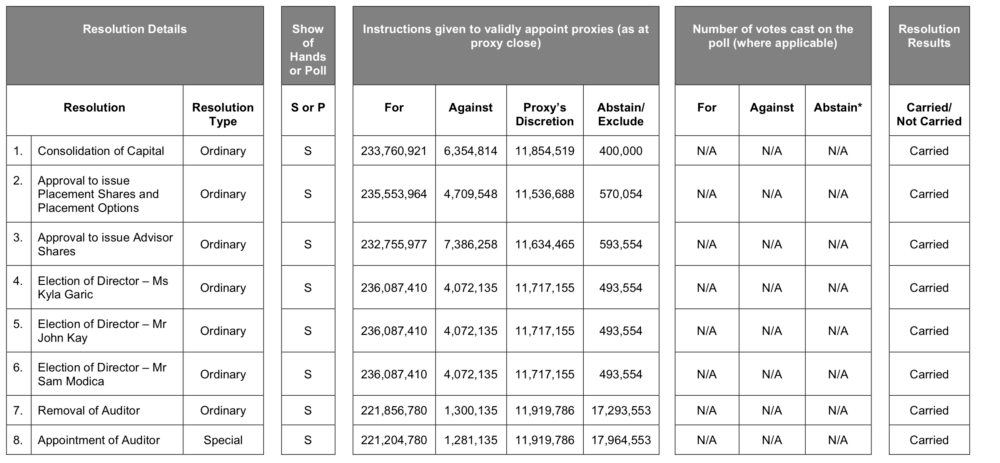

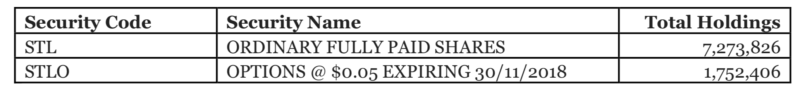

The announcement concerns Stargroup’s consolidation of capital. The Deed Administrators confirm that, further to the resolution carried at the shareholders meeting of October 17, 2018, consolidation of Stargroup’s issued capital was completed by the Australian Securities Exchange on October 30, 2018.

In addition, 2.5 million Performance Shares were consolidated into 25,000 Performance Shares.

Let’s recall that the administration covers Stargroup Ltd, Star Payment Systems Pty Ltd, Stargroup Investments Limited, and Star ATM Pty Ltd.

Securities in Stargroup have been suspended from official quotation on ASX since October 19, 2017, as the company said an announcement on its debt restructuring was due. About a month later, on November 20, 2017, the company announced that it appointed Richard Tucker and John Bumbak of KordaMentha Restructuring as Receivers and Managers. The Receivers and Managers have advised that they intend to pursue a “business as usual” strategy and that they start an immediate process to seek expressions of interest to sell or recapitalize the business.

In early December 2017, Stargroup announced that Mr Todd Zani had stepped down from his role as Chief Executive Officer of the company. Mr Zani is no longer employed by the company, Stargroup said back in December.

The General Meeting held on October 17, 2018, saw all resolutions passed by shareholders on a show of hands. Also, Nexia Perth Audit Services Pty Ltd has been removed as the auditor and replaced by Pitcher Partners BA&A Pty Ltd, effective from the close of the meeting.