Coronavirus and the markets: 3M shares and face mask sales – Guest Analysis

ATFX Chief Market Strategist Alejandro Zambrano takes a detailed look at how the demand for 3M face masks during the Coronavirus epidemic has led to a considerable focus on the publicly listed stock of the company by traders globally

By Alejandro Zambrano, Chief Market Strategist at ATFX

What is 3M?

In this article, we will explore the 3M Company (ticker: MMM). You will uncover their history, business model, and why they are in the spotlight at the start of 2020.

The 3M Company is a well-established conglomerate that started as the Minnesota Mining and Manufacturing Company in 1902.

They are unique as they offer more than 60,000 products, and their client base is truly global, making them a well-diversified company. They are also championing innovation and have developed many products in many industries that allow them to stay ahead of the curve. The company’s efforts have been rewarding and from 1968, when their share price was trading at $5.85, the price has risen by 40 times to reach the amount of $236 per share by the start of 2020.

They have developed products that you have probably used and did not think about as they are such parts of our everyday life like the Scotch tape and the According to 3M, people in over 200 countries use their products, and some of their most popular products are Scotchgard, Thinsulate, Scotch-Brite, Filtrete, Command, and Vikuiti.

Their efforts have made them one of the 500 most valued companies in the United States, and what is genuinely astonishing is that even if they have been around for more than 118 years, one-third of their sales come from products invented in the last five years.

Why the Coronavirus Crisis is shifting investors focus on the 3M Company

At the start of 2020, the Coronavirus, COVID-19, shifted the focus to 3M as the demand for its face masks rose sharply.

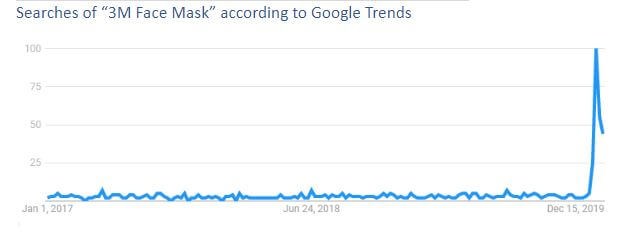

From having a stable number of worldwide searches on google, the interest in 3M face masks per Google trends increased by 33 times. Singapore, Hong Kong, Malaysia, and the Philippines dominated the searches given their proximity to the epicenter of the crisis.

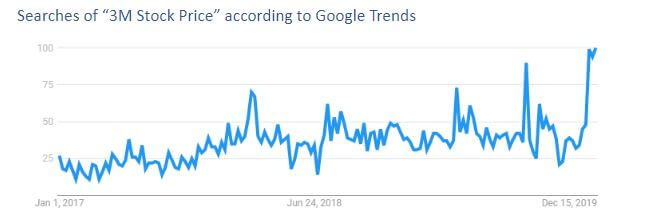

The high demand for face masks also spurred a higher interest in the 3M share price. The price trades under the ticker MMM in New York, and by the end of January and early February, searches on “3M share price” had risen by 2.5 times.

However, the share price of the firm has not increased since the start of the Coronavirus crisis. Instead, it dropped by 14.43% from its 2020 high to February 2. The reason for the slide in the share prices was the firm’s disappointing earnings report for Q4 2019.

Disappointing Earnings

Earnings per share were $1.95 per share, and lower than the $2.10 projected by stock analysts. The mood of investors took a further hit, as the firm announced that discharges from its facility in Decatur, Alabama might not have complied with permit requirements. As a consequence, the company received a federal grand jury subpoena by the end of 2019.

Their organic sales fell by 2.6%, yet profits took a bigger hit and declined to $969 million, a slide of 28%.

Face Mask Sales

As for the increased demand for its face masks, Michael Roman, the CEO, and Chairman said on January 28, 2020, that China was challenging and hinted that the higher demand for face masks would probably not outstrip the loss of business because of the shut down of the Chinese economy.

The reason for this is that 3M is probably one of the US’ most well-diversified companies with over 60,000 products, and the health care business is just one of five primary revenue streams. The healthcare business generates about 17% of all sales of the firm, and the selling of facemask, probably an even smaller percentage of all transactions.

Yet, the firm had over 6000 Chinese employees in 2017, nine manufacturing sites, and has one of four global research labs in the country, serving the world and Chinese consumers and firms.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.