Counterparty credit risk in FX: A very close look – FinanceFeeds Research

The risk arising from the possibility that the counterparty may default on amounts owned on a derivative transaction has become a focal point for liquidity providers, prime brokerage, and even Tier 1 banks whose liquidity is aggregated by non-bank institutional providers which connect retail trading platforms via a single point connection. This matter has become […]

The risk arising from the possibility that the counterparty may default on amounts owned on a derivative transaction has become a focal point for liquidity providers, prime brokerage, and even Tier 1 banks whose liquidity is aggregated by non-bank institutional providers which connect retail trading platforms via a single point connection.

This matter has become so vitally important that it is becoming increasingly difficult for OTC FX brokerages to secure relationships with prime brokers for providing FX (and other electronically traded asset classes) on an OTC basis to retail customers.

What is the main difficulty?

There is a very large school of thought that attributes the increasing difficulties in securing credit with banks to the Swiss National Bank’s decision to remove the 1.20 peg on the EURCHF pair in January 2015 which caused unprecedented market volatility, and exposed many retail and commercial brokerages which process their order flow on an agency (A-book) basis to negative client balances, meaning that they owed the bank sums of capital that could not be repaid, and in some cases were forced out of business.

The larger brokers survived, but were impacted heavily.

It is clear, however, that the Swiss National Bank’s decision was absolutely not the reason why credit is hard to obtain, nor was it a catalyst, as the banks which handle the majority of FX order flow were already looking closely at counterparty credit risk well before the ‘black swan’ event of January 2015, and in fact were doing so during a period of sustained low volatility.

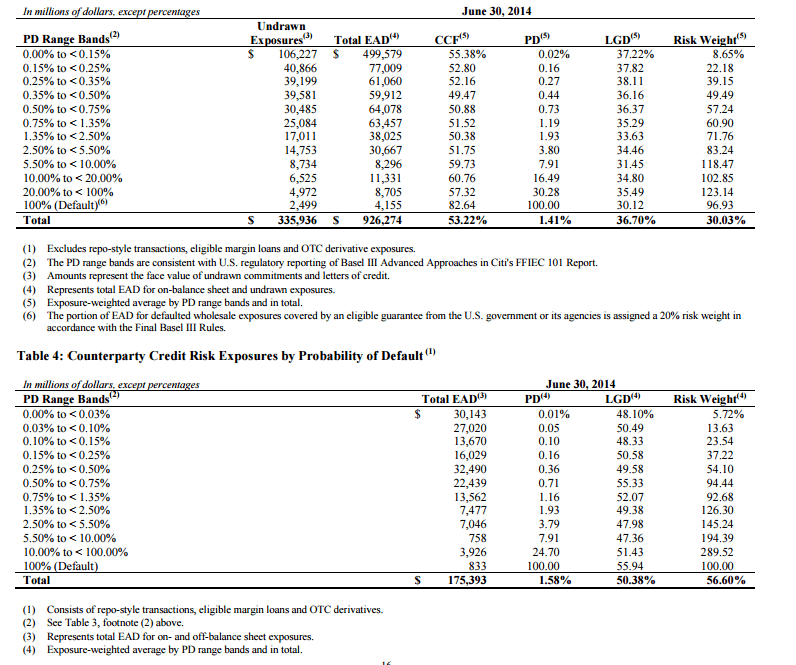

On June 30, 2014, Citigroup, the world’s number one FX dealer by market share, handling 16.11% of the global interbank order flow in 2015, published a corporate document on advanced approaches and disclosures for the Basel III regulatory framework for banks which separated OTC derivatives business in terms of probability of default (PD) compared to many other aspects of business.

When taking a look at the risk weight which was determined by that report, despite the much lower capital provided, the probability of default is substantially higher as per this table:

Just two months later, the low volatility of the markets was emphasized by FXCM CEO Drew Niv in the second quarter earnings call of 2014, futher illustrating the safe situation that the markets had been in for a sustained period of time “The challenging market conditions continued in Q2. Currency volatility which has been declining steadily since June 2013 continued to drop throughout the second quarter hitting record lows near to end of June and continuing to drop in the month of July” said Mr. Niv at the time.

As the call continued, Mr. Niv stated “The volatility dropped to levels lower than any in the 21 years since the currency volatility index has been calculated. Last quarter, I said that the first three months of this year were the worst trading conditions I had seen in the 15 plus years I have been in this business, and I need to revise that statement that Q2 was much worse.”

Bearing this in mind, banks were taking a very conservative approach to credit risk, even in market conditions which were in their favor.

Indeed, as far back as 2010, the Federal Reserve Bank of New York produced a document about credit risk in FX, detailing its best practice guidelines which apply to banks giving credit to FX brokers and prime brokers on an OTC basis.

Within these guidelines were two important frameworks:

Netting agreements

These are agreements that reduce the size of counterparty exposures by requiring the counterparties to offset trades so that only a net amount in each currency is settled and provide for a single net payment upon the closeout of all transactions in the event of a default or termination event.

Collateral arrangements

These are arrangements in which one or both parties to a transaction agree to post collateral (usually cash or liquid securities) for the purpose of securing credit exposures that may arise from their financial transactions.

During 2010, the Dodd-Frank Wall Street Reform Act was sworn into US law by President Obama, an act which prescribed that all OTC retail FX firms should have a net capital adequacy for regulatory purposes of no less than $20 million.

Banks taking the cautious line – Watch the percentages in the terms and conditions

The New York Federal Reserve considers that much higher requirements are in place, even though it is widely recognized in the retail FX industry that the stipulations made by the US government are far in excess of those made anywhere else.

The central bank asked participants some 6 years ago to consider an example in which a client had a net positive mark-to-market exposure to Lehman Brothers of $50 million.

With an agreement by the International Swaps and Derivatives Association in place, the client was able to net the outstanding positions and was ensured that Lehman would be unable to “cherry pick” the winning trades from the losing trades.

However, without a CSA (credit support annex) in place and the associated placement of collateral, the client was still forced to replace the positions lost due to the bankruptcy, or the $50 million replacement cost, and wait for a number of years for some recovery on its $50 million claim in the bankruptcy.

A year later, banking giants HSBC and JPMorgan founded FX prime brokerage businesses, and the liquidity from both institutions is now commonly present as part of aggregated feeds provided by broker technology firms and non-bank specialist liquidity providers to FX brokerages.

When examining the terms and conditions set out by JPMorgan’s prime brokerage division, it is clear that a very conservative approach was taken from the outset.

In July 2012, the firm stated that the amounts which may be rehypothecated under a Prime Brokerage or margin account relationship are generally limited to 140% of the outstanding liability (or debit balance) to the Prime Broker or lender (or such other applicable legal limit).

For the purposes of the return of any collateral to customer, the account agreements provide for the return of obligations by delivering securities or other financial assets of the same issuer, class and quantity as the collateral initially transferred.

How much do I need to operate directly with a Tier 1 bank? – I find out….

Research that I conducted with regard to opening a client deposit account for FX brokerages demonstrated not only the variation between large, Tier 1 banks and their criteria, but also the commercial attitude toward retail FX brokerages.

NatWest, part of the RBS group, as well as RBS’ corporate division itself, stipulate no minimum deposit and no required minimum daily balance for client money holding accounts, however when I enquired as to whether this service was available for small retail FX brokerages, the answer was a resounding no. Law firms and insurance agents, yes, but FX companies serving retail clients, no.

Chase Private Client, the client money holding account offered by Chase, will accept certain FX brokerages according to very stringent conditions but expects a $250,000 average ledger balance to be maintained at all times (made up of either cash or qualifying deposits and investments linked with the account – ie collateral) and a minimum daily balance of $15,000 or more.

Bearing in mind that this is a separate matter from operating capital requirements and operating costs, and a separate matter from regulatory capital requirements, it is clear that banks have a strict risk management profile.

How brokers are looking to mitigate risk, yet offer modern and attractive services

Smaller brokerages which transfer their entire order flow to their liquidity providers, and white label partners of retail brokerages should bear in mind that if they are operating a pure A-book (which is very very rare) the chances of being outside these parameters is high, and therefore at the end of the liquidity chain, the banks will intervene, ultimately limiting the activities of smaller, less capitalized firms.

It is possible for all brokerages to assess this carefully by using online services such as the S&P Global Market Intelligence Platform, which is designed to help firms measure and manage their credit risk exposure by screening benchmark relative financial and credit metrics.

Companies such as Traiana, which is the post-trade clearing, risk management and settlement division of British interdealer brokerage ICAP, provide services including automated post-trade processing for give-ups, allocations and clearing of CFDs, which have become very popular since the Swiss National Bank event in January 2015 as a form of OTC futures contract which many brokerages are viewing as a means of lowering the risk of negative balance exposure which may ensue from high volatility.

Britain’s electronic trading sector has, for many years, been centered on CFD trading and spread betting, necessitating the development and maintenance of proprietary platforms by London’s long-established retail FX giants.

During the last two years, there has been a distinct drive toward taking the CFD product to an international audience, and some very significant mergers and acquisitions have come about as a result, a notable example being the purchase of City Index by GAIN Capital for a sum that was at the time reported to be $118 million in October 2014.

Subsequently, it emerged that the net purchase price was actually $82 million, which included $36 million in cash.

The drive toward adding CFDs to global product ranges was relatively short lived, and has now become a very quiet and somewhat distant dynamic. It may well be that the reason for this is the inability to clear currency-based CFDs, despite certain services being available to clear equity CFDs as per the Traiana Harmony network, and also the very wide spreads which can ensue due to the OTC nature of a futures contract being intrinsically difficult to assess from a buy-side perspective.

Today’s new dynamic is hailing from North America, where the institutional exchange technology providers and exchange-traded futures and equities platform developers are looking closely toward a retail audience, which sets a centralized exchange in position.

It will be interesting to monitor the approach to risk management and how much counterparty credit ratios differ should this be adopted on a widespread basis in the United States… QED.