CQG launches Aggregation Trader for orders on two or more exchanges

The account sending an aggregated order must have margin availability as if independent leg orders for the total number of lots were executed.

CQG has announced the launch of Aggregation Trader, a new trading application for traders who want to simultaneously work orders on two or more exchanges.

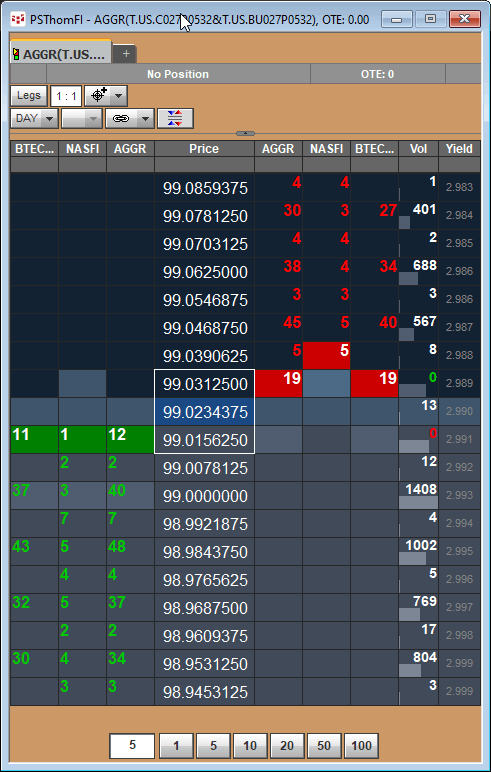

The primary goal of this interface is to allow the trader to place/observe/modify/cancel orders for individual legs of the aggregated contracts, using dedicated individual columns.

Traders can work with several ‘similar’ contracts from a single interface, the firm explained.

Aggregation Trader allows orders in two or more exchanges

The Aggregation Trader allows users to place a single order for similar instruments in two or more exchanges and let the system find the market with the best bid or offer.

The primary goal of this interface is to allow the trader to place/observe/modify/cancel orders for individual legs of the aggregated contracts, using dedicated individual columns. Traders can work with several ‘similar’ contracts from a single interface.

Aggregation Trader displays the depth-of-market data for both exchanges and the aggregated totals. In addition, working orders can be modified by various popup order grids such as from the order cell.

The order can be modified from the Exchange header and from the top of the Aggregation Trader header.

The account sending an aggregated order must have margin availability as if independent leg orders for the total number of lots were executed.

Market Taking or Market Making mode

Aggregation has two modes: Market Taking (default) and Market Making:

Market Taking Mode: Your order is held on the gateway server until your price becomes available in at least one market; at which time, the gateway server sends an order to the exchange. The configurable parameters for this mode are:

•Trading Distribution

•Partial Fill Control

•Working Threshold

•Order Type

Market Making Mode: Your order is sent immediately to the exchanges based on your trading distribution preferences. The gateway server then manages your orders to get you filled as quickly as possible at your price. The configurable parameters for this mode are:

•Trading Distribution

•Overfill Management

The system works the complete size at one time. If lots cannot be evenly divided by the number of instruments, then the remainder is allocated to the first instrument.