CQG revamps its platform with new features for crypto trading

CQG, a provider of technology for integrating market data, technical analysis and trade routing, has rolled out new updates with the enhancements concerning desktop and web versions of its platform.

The global financial software provider has expanded the features of CQG Desktop Version 7.3 to provide decimal points for volume displays throughout (cryptos). It also added preference to show group/country/region code for symbols.

The revamped terminal also added a new option to cancel orders on logoff, and improved functionality to download order reports with several criteria.

The new updates offer CQG users many of the benefits available from existing bespoke platforms, but with the efficiency of a customizable backend. Brokers are now able to determine everything from the layout and set-up, including the back-end configurations and user interface.

CQG expands its list of direct trading connections

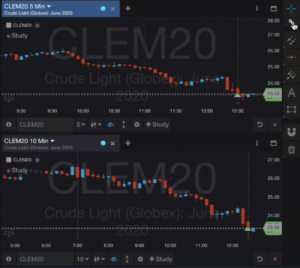

The company also added a ‘Volume Profile’ study for its newest trading platform, CQG One. The phased roll-out introduces a cloud-based platform with access to CQG Algos, new analytics features, custom formulas, price alerts and a spreader.

The new product combines the ease of use of CQG’s retail-oriented terminal with market data, charting, visualization and advanced features of its flagship professional trading platform, CQG Integrated Client.

CQG One caters mainly to professional traders and institutional investors, acting as a multi-asset, multi-broker platform that offers a comprehensive set of pre-built algorithmic order types. The Denver-based firm made the new platform available through traders’ futures commission merchants (FCMs) beginning in April, with new functionality added throughout the year.

Among other things, the new platform will include premium functionality such as single-click trade entry, portfolio sharing, window linking, and drag-and-drop tabs. CQG One also offers consolidated real-time and life-of-contract historical market data feeds from more than 75 global sources.

CQG’s network of electronic trading gateways provides traders with market data, graphical analysis and low-latency trading access to a global network of futures and options exchanges as well as fixed income and foreign exchange markets. The institutional-oriented brokerage group says it is offering a significant destination for customers who want to capitalize on diverse global markets.