CQG rolls out new version of desktop platform

CQG Desktop Version 5.1 offers a raft of enhancements, including displaying volume profile on HOT and adding the ability to modify iceberg visibility of working orders.

Provider of high-performance trading, market data, and technical analysis tools CQG has announced the release of version 5.1 of its desktop platform.

The latest version of the solution is equipped with a series of enhancements concerning charting, quotes and trading.

Regarding trading, users of the platform can now view volume profile on HOT. In the HOT widget, go to the task menu and select “Show Volume Profile (session)”. In CQG IC, this setting is called Total Volume Column with additional settings for day or session. In CQG Desktop session volume has been implemented.

Regarding trading, users of the platform can now view volume profile on HOT. In the HOT widget, go to the task menu and select “Show Volume Profile (session)”. In CQG IC, this setting is called Total Volume Column with additional settings for day or session. In CQG Desktop session volume has been implemented.

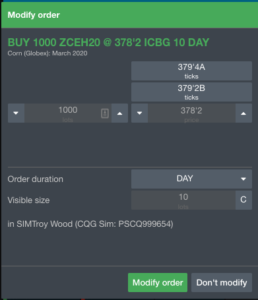

Traders also get the ability to modify iceberg visibility of working orders. When traders have a working iceberg order, they can now modify the visible size from the Modify order dialog.

There are also column filters for accounts widgets and the platform now features a parked orders widget.

There are also column filters for accounts widgets and the platform now features a parked orders widget.

Regarding quotes, users of the platform can see yesterday’s open, high, and low columns in QSS/SST.

In terms of charting enhancements, Williams %R, Hull and Keltner channel studies have been added.

Let’s recall that, earlier this year CQG announced the rollout of version 4.10 of the platform. That version added a widget called “Positions by Commodity” which displays positions grouped by commodity with columns for each month/year contract. This makes it easy for curve traders or anyone holding positions for a commodity across different months to see their positions.

Further, traders got the ability to recenter all HOTs quickly. Whenever traders have more than one HOT on a page, a button will appear in the left bar to center all of the HOTs on the page. Additionally, CTRL + click on any HOT reset button will reset all HOTs on the page.

In addition, traders can enter text to create a row as a separator to help visually separate symbols in the QSS and SST. When in symbol entry, use an apostrophe ‘ to tell the system you want to display text instead of a symbol. Then right-click and select a color to highlight the cell for additional highlight.