Credit Suisse CEO Tidjane Thiam to take massive bonus hit after catastrophic results

Following the announcement of a £1.65 billion loss in its annual report for 2015, Credit Suisse Group AG (ADR) (NYSE:CS), the largest foreign broker by market share across seven regions in the Asia Pacific region and 12th largest interbank FX dealer in the world by market share, had announced that it was set to cut […]

Following the announcement of a £1.65 billion loss in its annual report for 2015, Credit Suisse Group AG (ADR) (NYSE:CS), the largest foreign broker by market share across seven regions in the Asia Pacific region and 12th largest interbank FX dealer in the world by market share, had announced that it was set to cut 4,000 jobs and reduce bonuses for its investment banking executives by 36%, the bank’s CEO Tidjane Thiam prepares to take his share of the burden.

Mr. Thiam, who has led the firm during the year in which it made its first annual loss in 8 years, is preparing to forfeit part of his bonus by request, having divulged to Swiss news source Sonntagzeitung yesterday that the cut to his bonus would be the largest among the leadership team.

Mr. Thiam will still receive a bonus, however, despite the balance sheet of the firm over which he presides having a balance sheet which is further into the red than that of 2007, the last year in which the bank did not make profit.

During recent years, Credit Suisse has lost considerable market share among interbank FX dealers, having been the second largest FX dealer worldwide at the turn of the decade, whereas six years on, it languishes in 12th place in terms of global market share.

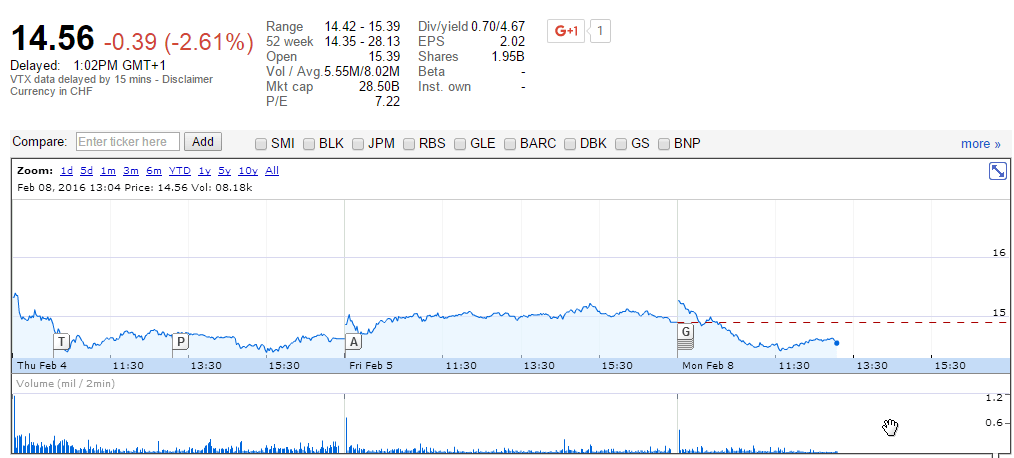

The extent to which Mr. Thiam’s bonus will be cut in terms of monetary value has not been disclosed, however another metric to bear in mind is the collapsing value of Credit Suisse stock, which today is down 0.39 points to CHF 14.56 today from CHF 15.4 yesterday.

Chart courtesy of Google Finance