Credit Suisse makes first annual loss in 8 years, prepares to cut 4,000 jobs

Annual results for 2015 for major institutions with large presence in the interbank FX sector have begun to display the realities behind last year’s tumultuous times. Credit Suisse Group AG (ADR) (NYSE:CS) which is hte largest foreign broker by market share across seven regions in the Asia Pacific region, but has fallen to 12th place worldwide […]

Annual results for 2015 for major institutions with large presence in the interbank FX sector have begun to display the realities behind last year’s tumultuous times.

Credit Suisse Group AG (ADR) (NYSE:CS) which is hte largest foreign broker by market share across seven regions in the Asia Pacific region, but has fallen to 12th place worldwide in terms of volume over the last year and a half, has reported an annual loss of CHF 2.42bn (£1.65bn) for the full year.

These figures are actually worse than the CHF 2.09bn that analysts had forecast, and include a fourth quarter loss of CHF 6.4bn.

Core pre-tax revenues for 2015 weighed in at CHF 88 million, however a loss of CHF 5.3 billion was recorded in terms of pre-tax income.

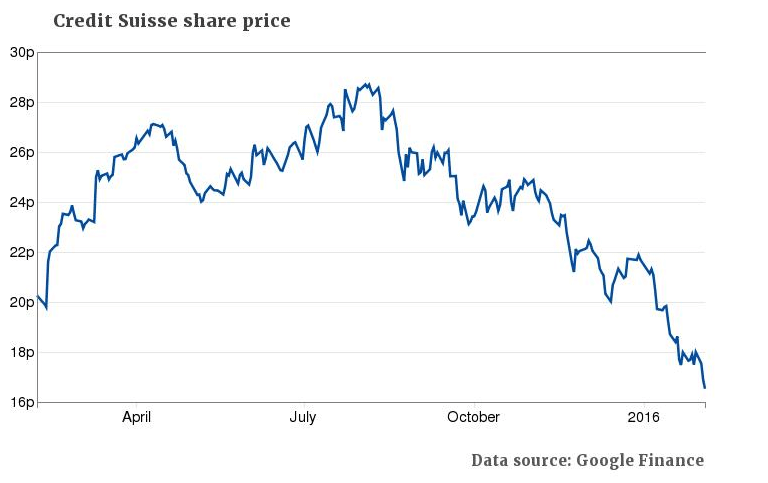

As a result of this loss having now been made publicly available information, Credit Suisse share prices have dropped with the velocity of a falling iron girder, and the company is now preparing to cut 4,000 jobs.

Commenting on the firm’s corporate performance within the annual report, Credit Suisse CEO Tidjane Thiam said:

“The fourth quarter of 2015 was characterised by volatile market conditions, pressures on market liquidity, a sharp decline in oil prices, widening credit spreads, continued uncertainty linked to asynchronous monetary policies, and large fund redemptions by market participants affecting asset prices.”

In keeping with FinanceFeeds analysis at the beginning of this year with regard to corporate strategy, Credit Suisse aligns itself with the rest of the larger firms in the FX industry in that it has concentrated on mergers and acquisition activity over the last five years during a time at which this was a very popular method of expansion for many institutions and non-bank FX companies, but has now subsided.

With regard to mergers and acqusitions, Credit Suisse is still looking to further its portfolio, with Mr. Thiam having said:

“The overall pipeline into 2016 is strong, notwithstanding the challenging market conditions in January.”

Despite the losses sustained in 2015, Mr. Thiam remains very positive about internal affairs at Credit Suisse, citing market conditions as a major factor to consider.

He said:

“A combination of uncertainties on Chinese growth, the abrupt drop in oil prices, large industry mutual fund redemptions of financial assets, asynchronous policies by leading central banks, lower liquidity, a strong Swiss franc have all contributed to making the fourth quarter of 2015 challenging with lower levels of client activity, lower levels of issuance and material shifts in the prices of some asset classes. In that context, the bank has delivered a resilient performance.”

“Market conditions in January 2016 have remained challenging and we expect markets to remain volatile throughout the remainder of the first quarter of 2016 as macroeconomic issues persist. We expect to continue to make progress on the key dimensions of our strategy as we continue the restructuring of the bank to position it well for the future, beyond 2016.”

Share prices for Credit Suisse stock were down 1.88 points to CHF 14.65 at 12.00 CET today, down 11.37% from yesterday’s close.