Credit Suisse registers 75% jump in net income in Q1 2020

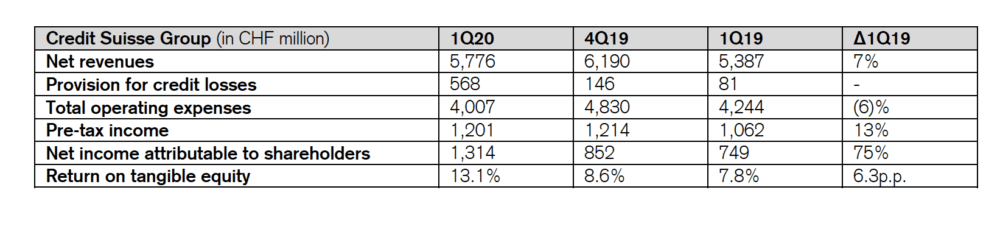

Net income was up 75% year on year at CHF 1.3 billion, the highest quarterly result in the last five years, benefitting from a negative tax rate.

Credit Suisse today posted its financial report for the first quarter of 2020, revealing a steep increase in net income.

Pre-tax income for the period grew 13% year on year and amounted to CHF 1.2 billion, including the gain from the second and final closing of the InvestLab funds platform transfer to Allfunds Group. Excluding the gain from the InvestLab transfer and major litigation provisions, pre-tax income would have been CHF 951 million, down 11% year on year.

Net income was up 75% year on year at CHF 1.3 billion, the highest quarterly result in the last five years, benefitting from a negative tax rate.

Credit Suisse posted net revenues of CHF 5.8 billion for the first quarter of 2020, up 7% year on year; excluding the gain from the InvestLab transfer, net revenues would have been up 2%.

The results for the first quarter of 2020 were supported by a strong contribution from Credit Suisse’s Private Banking franchises, with net revenues excluding the gain from the InvestLab transfer up 9% year on year. Amid a market sell-off, Credit Suisse’s Private Banking franchises reported increased transaction-based revenues, up 31% year on year, as well as stable recurring commissions and fees, while net interest income increased 6%. Total Investment Banking net revenues in the first quarter of 2020 were up 23% year on year, on a US dollar basis, benefitting from a diversified portfolio, with Fixed Income sales and trading net revenues up 26% and Equity sales and trading net revenues up 24%.

To reflect the challenging economic environment and continued pressure on oil prices, Credit Suisse absorbed over CHF 1 billion of reserve build in the first quarter of 2020.

Although Credit Suisse recorded Net New Assets (NNA) of CHF 5.8 billion across its businesses in the first quarter of 2020, with CHF0.6 billion in SUB, CHF 3.8 billion in IWM, and CHF 3.0 billion in APAC, its Assets under Management (AuM) decreased by CHF 0.1 trillion to CHF 1.4 trillion at the end of the quarter compared to the previous quarter, driven by unfavorable market and foreign exchange-related movements.

As part of its strategy to be a leading global wealth manager with strong investment banking capabilities, earlier this month, Credit Suisse announced that it received approval from the China Securities Regulatory Commission to become a majority shareholder in its securities joint venture, Credit Suisse Founder Securities Limited, marking a significant milestone in the bank’s China strategy.

Credit Suisse notes that it has entered this crisis with a number of key advantages, including having profitable and resilient operations in its Swiss home market that has historically had a low credit loss experience, as well as having decreased its risk exposure following its 2015 to 2018 restructuring program, including its oil & gas and leveraged finance exposure.

Despite Credit Suisse’s financial strength, the Board of Directors decided, in light of the COVID-19 pandemic and in response to a request by Swiss regulator FINMA, to revise its dividend proposal for the Annual General Meeting (AGM) on April 30, 2020. Under the revised approach, the Board of Directors proposes the distribution of half of the originally proposed dividend at the AGM, and intends to propose to an Extraordinary General Meeting (EGM) in the autumn of 2020 the distribution of the second half of the 2019 dividend, subject to market and economic conditions. Having completed the initial share repurchases under its 2020 share buyback program, under which it had bought back shares of CHF 325 million, further repurchases are on hold until at least 3Q20 to allow Credit Suisse time to reassess the impact of the persisting pandemic.