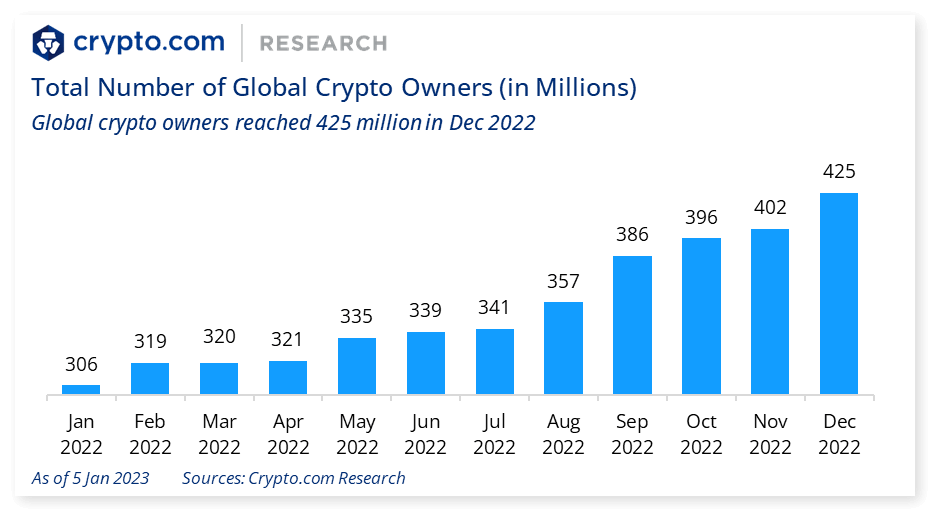

Crypto.com’s 2022 report notes that global crypto ownership increased by 39% despite ‘winter’

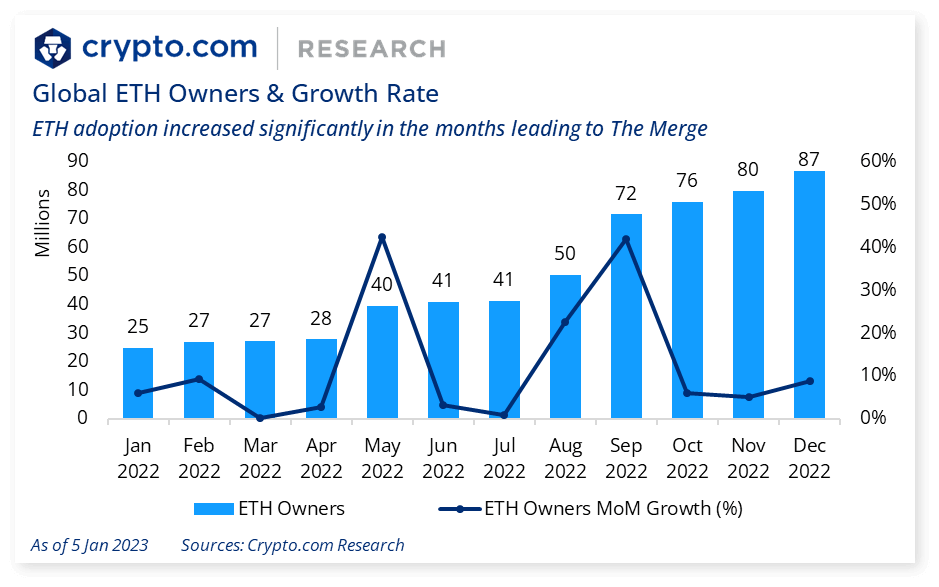

Ethereum (ETH) owners grew by 263% from 24 million in January to 87 million in December, accounting for 20% of global owners.

Crypto.com has published its Crypto Market Sizing Report 2022, which provides insights into the actual dynamics within the digital asset market.

The key takeaway of the report is that global crypto owners increased by 39% in 2022, rising from 306 million in January to 425 million in December in spite of macro headwinds, namely high inflation, the conflict in Europe, supply chain disruptions, and lingering effects of the COVID-19 pandemic.

As to the top crypto assets in the market:

- Bitcoin (BTC) owners grew by 20% from 183 million in January to 219 million in December, accounting for 52% of global owners;

- Ethereum (ETH) owners grew by 263% from 24 million in January to 87 million in December, accounting for 20% of global owners.

For Bitcoin, the strongest growth in 2022 happened in April when the Central African Republic became the second country to adopt BTC as legal tender after EI Salvador and Goldman Sachs offered its first BTC-backed loan, showing further signs of increased interest in crypto from Wall Street institutions.

Crypto.com further explained that the main catalyst behind Ethereum’s high adoption growth rate – ETH owners grew by 263% vs BTC owners that grew by 20% – was The Merge: a highly anticipated event that marked the completion of the network’s transition from a proof-of-work to a proof-of-stake consensus algorithm.

Ethereum’s rising adoption in 2022 was also due to interest from institutional investors and the popularity of ETH liquid staking.

Crypto.com lays off 1,000 people and delists Tether (USDT) in Canada

Although Bitcoin and Ethereum experienced a positive week in terms of market prices, the FTX contagion is spreading and made a new victim. Genesis, a subsidiary of Digital Currency Group, has filed for Chapter 11 bankruptcy.

Amid the ‘crypto winter’, digital assets exchanges have been announcing lay offs. This is the case for Crypto.com, which plans to lay off 20% of its corporate workforce, or nearly 1000 people, in order to adapt to current market conditions, CEO Kris Marszalek said in a tweet on Friday.

Employees were told the firm was seeking to trim expenses and narrow its focus to more-promising businesses amid chilly crypto winter. Marszalek said several factors played into their decision to reduce headcount. Despite maintaining a strong balance sheet, he claims, Crypto.com had to navigate economic headwinds and unforeseeable industry events. He explains that they grew ambitiously at the start of 2022, aligning with the broader industry, but the trajectory has now changed with a confluence of negative developments.

Crypto.com also made headlines after it told its Canadian customers that it will delist Tether’s stablecoin (USDT) trading, transactions, deposits and withdrawals by the end of this month.

The write-off of the world’s largest and most liquid stablecoin comes as the Ontario Securities Commission (OSC) has banned crypto exchanges operating in the region from touching Tether (USDT). The decision dates back to 2021 when the stablecoin was deeply linked to alleged market manipulation, and it was the only prohibited digital asset in the country.