Crypto ETPs to grow beyond $120b by 2028 even without regulatory clarity in US – research

“In the U.S., regulatory concern is the top reason advisors haven’t invested in crypto assets. We believe a Bitcoin ETF approval would alleviate these concerns.”

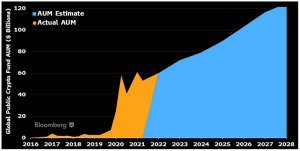

Assets under management in crypto Exchange Traded Products (ETPs) are estimated to grow beyond $120 billion by 2028, according to a new report by Bloomberg Intelligence (BI).

The extraordinary adoption of crypto ETPs is expected to take place even absent large crypto price increases, fuelled by increasing institutional demand and changes in U.S. policy.

Other findings of Bloomberg Intelligence’s latest 2022 Crypto Outlook include that regulatory approval is a key catalyst for a spot Bitcoin ETF by the end of 2023, which could see tens of billions in assets added to crypto funds.

U.S. advisors control about $26 trillion, but only a small minority of those advisors have exposure to crypto, and the majority who do, allocate only 1% or less of their clients’ portfolios. This means there is a huge potential for crypto ETPs in the future.

More liquidity for institutions, more brokers for retail investors

Institutions taking crypto positions rose to 52% last year, up from 33% in 2019, bringing further liquidity to the sector. The retail segment is also experiencing more involvement as the number of broker-dealers in the U.S. offering crypto products continues to grow.

Julie Chariell, Senior Fintech Industry Analyst at Bloomberg Intelligence, said: “Bitcoin turns 13 years old in 2022, barreling into its teenage years marked by greater independence in the form of decentralization, some rebelliousness, as seen in its volatility, and formation of identity as in its store of value or medium of exchange. With some discipline, through regulation, crypto has the potential to achieve acceptance by peers in the shape of mainstream adoption.”

James Seyffart, ETF Strategist at Bloomberg Intelligence said: “The number of publicly listed cryptocurrency funds – mostly tracking Bitcoin and Ethereum – should sustain the rapid growth of the past two years through 2022 and into 2023 as more countries allow the launch of spot products and regulators get more comfortable with digital assets.

“In the U.S., regulatory concern is the top reason advisors haven’t invested in crypto assets. We believe a Bitcoin ETF approval would alleviate these concerns. The SEC has regulated the crypto industry with enforcement rather than offering regulatory clarity thus far but the industry is likely to get significantly increased clarity over the coming years from Biden’s crypto executive order and from SEC rule proposal expansions. All of which will cause the growth of crypto fund assets.”

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence said: “There’s little doubt Bitcoin is the most fluid, 24/7 global trading vehicle in history and well on its way to becoming digital collateral in a world going that way.”

The report counted at least 107 cryptocurrency funds with 119 share classes listed on public exchanges globally, including ETFs, CEFs, mutual funds, and trusts.

Fund issuers see massive potential for asset growth in the crypto space, but with no spot option in the U.S., investors seeking crypto exposure are left with futures ETFs that incur roll costs and trusts that trade away from their underlying value.

Bloomberg Intelligence expects the number of funds to increase slightly alongside assets in 2022 as the SEC withholds approval of spot Bitcoin ETFs.