Crypto funds post net inflows for 2nd straight week

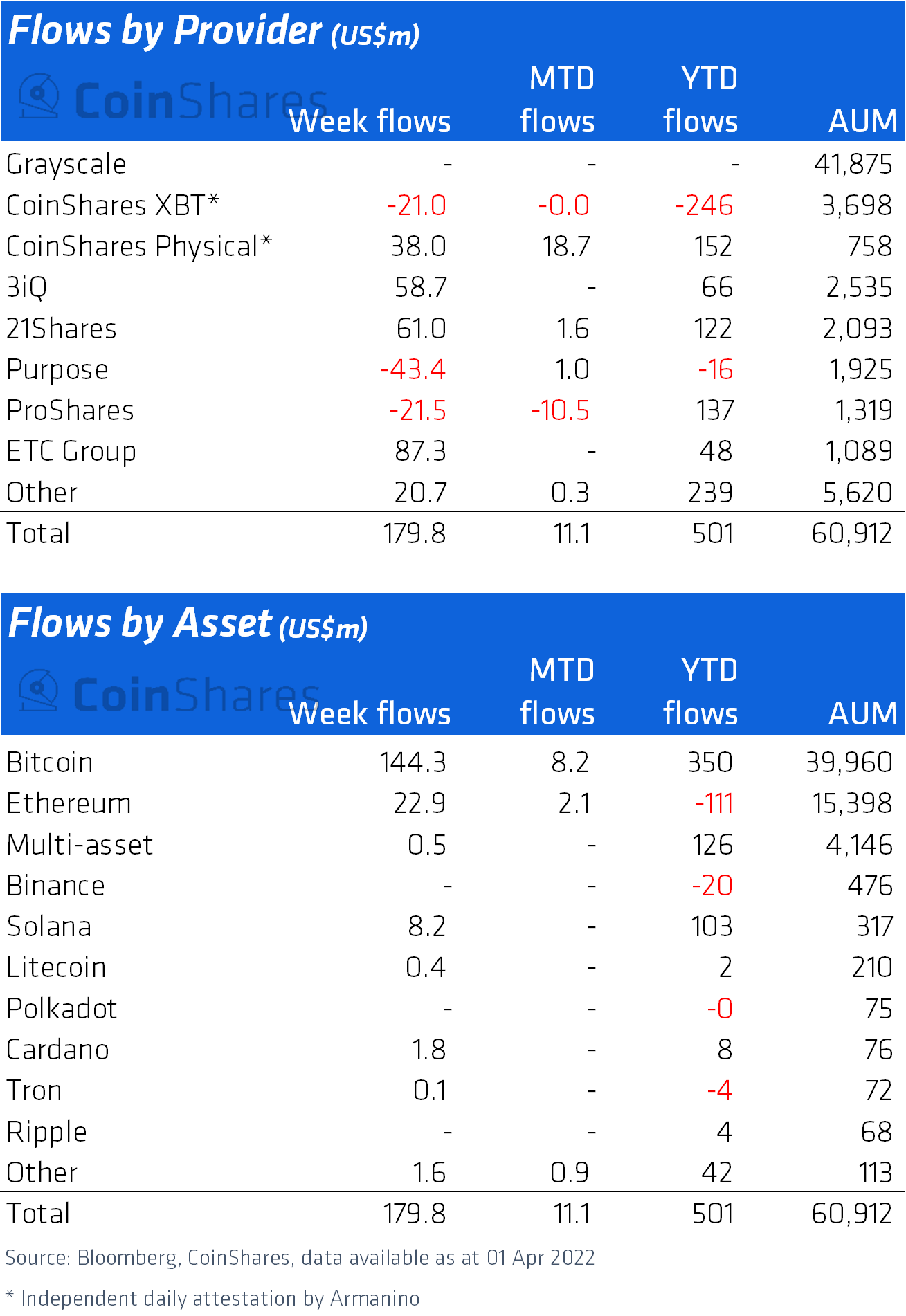

CoinShares’ weekly survey of cryptocurrency fund flows shows that total investment inflows into digital assets hit $180 million last week.

The asset manager writes that the reporting of some late trades also pushed up the previous week inflows from $193 million to $244 million. The renewed inflows suggest the recent headwinds for digital assets, such as the significant price weakness, were seen as buying opportunities for investors.

Year-to-date net flows have now hit $501 million while total assets under management (AuM) have recovered to $61 billion, the highest level since January 2022. Regionally, flows have been one-sided, with 99% of inflows derived from Europe, while the Americas remain hesitant, seeing only $1.7 million of inflows.

Interestingly, Bitcoin saw weekly inflows of $144 million. Overall, the primary coin saw $350 million in year-to-date inflows, representing 0.9% of AuM. However, BTC inflows are lagging relative to last year, where Bitcoin saw inflows totalling $3 billion in the first quarter, a particularly euphoric period for the crypto industry.

Europe’s largest digital asset investment firm said Ethereum investment products saw minor inflows at $23 million. The second largest cryptocurrency in terms of market capitalisation witnessed the biggest blow so far in 2022, with YTD outflow of $111 million. This contrasts to the first quarter 2021 where we saw inflows totalling $705 million.

Altcoin investments recover

Breaking down the latest statistics, Coinshares said decent outflows were seen in most altcoins’ investment products. Solana and Cardano were the best performers with inflows of $8.2 million and $1.8 million respectively. Solana is now the 3rd best performing investment product with inflows year-to-date totalling $103 million.

CoinShares made headlines last month after buying additional 20 percent stake in digital bank FlowBank, which is licensed by the Swiss Financial Market Supervisory Authority.

Founded by former LCG CEO, Charles-Henri Sabet, FlowBank promises to smooth the online trading and banking experience with a software platform that allows clients to invest in different asset classes, including cryptocurrencies, from a single account.

Through its strategic investment, CoinShares says it allows its clients to leverage the Swiss banking’s heritage. Flowbank clients also can now invest in CoinShares’ crypto ETPs and other tokenised assets directly from their Flowbank account.