Crypto investment flows show less bets on Bitcoin decline

As the price of bitcoin continues to consolidate around recent lows, investors trimmed their positions in funds designed to profit from further declines in the cryptocurrency.

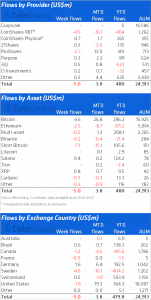

Investors redeemed a net $7.1 million from short bitcoin funds in the seven days through October 21, the crypto asset manager CoinShares wrote. On a month-to-date basis, assets under management (AUM) in these funds had hit an all-time high of $15 million, representing 10% of total AuM.

While flows have been mixed recently for short-bitcoin, it was the only investment product showing some semblance of conviction in direction of trade at present. The retreat in the short bitcoin positions is usually a bullish sign and might be suggesting negative sentiment is close to its peak.

Overall, there were minor inflows for Bitcoin-specific funds for the 6th consecutive week, which totaled $4.6 million.

In terms of the entire AUM of all funds that CoinShares tracks, last week’s outflows were $5 million in a continuation of this apathetic period that began in September. Excluding the outflows from short products would have led to an overall minor inflow last week.

This trend is also highlighted by investment product volumes which were $758 million, the lowest since October 2020 and far off the average of $7 billion a week seen this time last year.

Breaking down the latest statistics, Coinshares said the aggregate data masks a significant regional polarization of views. In particular, Sweden, Canada and the US saw the most action with outflows totalling $4.5 million, $1.9 million and $1.2 million, while Germany, Brazil and Switzerland all saw minor inflows.

Apart from Bitcoin, Ethereum saw minor outflows for the third consecutive week totalling $2.5 million bringing outflows post the Merge to $11.5 million, just 0.2% of AuM. Other assets including XRP saw inflows of $0.8 million, while small they are close to the largest since the lawsuit with the SEC began.

CoinShares is Europe’s largest digital asset investment firm. The company reported its secomd quarter revenue at £14.2 million, down from Q2 2021’s £19.6 million. Adjusted EBITDA also dropped sharply to £8.2 million from £28.6 million in the three months through June 2021.

As the market environment has changed in the past three months, with cryptocurrencies under pressure, the institutional-favorite platform has experienced difficulties gaining confidence from investors. Though vowing to focus on “long-term growth,” as indicated in the report, the asset manager’s total comprehensive income for Q2 was a loss of £0.1 million from a positive income of £26.6 million in Q2 2021. That was Coinshare’s its first negative quarter since going public in March 2021.