Crypto investment inflows hit highest level since May 2021

Fresh investment inflows into crypto funds reached their highest amount since November 2021, CoinShares’ weekly survey shows. The jump marked a reversal of the recent trend that included straight weeks of outflows.

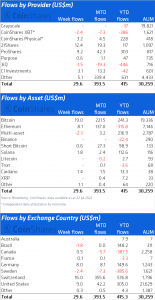

The asset manager writes that despite crypto prices range trading, Bitcoin saw inflows totaling $19 million last week with the prior week inflows corrected to $206 million, the largest single week inflows since May 2022.

Overall, digital asset investment products saw inflows of $27 million last week, while late reporting of trades from the prior week saw inflows corrected from $12 million to $343 million. That marks the largest single week of inflows in more than eight months.

Month-to-date net flows have now hit $394 million while total assets under management (AuM) have recovered back to early June 2022 levels of $30 billon. Regionally, flows have been almost one-sided, with the majority of inflows were from Switzerland totalling $16 million with the prior week seeing inflows of nearly $356 million, while year-to-date inflows sit at $577 million. Minor inflows were seen in both the US and Germany last week coming in at $9 million and $5 million respectively.

“Bitcoin saw inflows totalling $16m last week with the prior week of inflows corrected to $206m, the largest single week of inflows since May 2022. Short-Bitcoin saw inflows totalling $0.6m, with recent positive price performance for Bitcoin pushing down its AuM to $133m from July 13th peak of $145m,” the report further reads.

Outsized investments were also seen in Ethereum investment products, with the corrected prior week inflows coming in at $125 million last week. These inflows mark the largest single week of inflows since June 2021 and imply a turning point in sentiment after a recent 11-week run of outflows. It also suggests that as The Merge progresses to completion, investor confidence is slowly recovering.

CoinShares is Europe’s largest digital asset investment firm. The company reported its first quarter revenue at £27.96 million, down from Q1 2021’s £39.91 million. Adjusted EBITDA also halved to £18.7 million from £34.2 million in the three months through March 2021.

As the market environment has changed in the past three months, with cryptocurrencies under pressure, the institutional-favorite platform has experienced difficulties gaining confidence from investors. Though vowing to focus on “long-term growth,” as indicated in the report, the asset manager’s total comprehensive income for Q1 was £20.2 million, down from £32.1 million a year earlier.