Cryptocurrency fraud continues to raise concerns in Belgium

The black list of cryptocurrency trading platforms that exhibit signs of fraud now includes 113 names.

Belgium’s Financial Services and Markets Authority (FSMA) has earlier today announced the latest additions to its list of suspicious cryptocurrency-related websites that show signs of fraudulent activities. Today’s announcement underlines the growing concerns stemming from the rise of cryptocurrency scams.

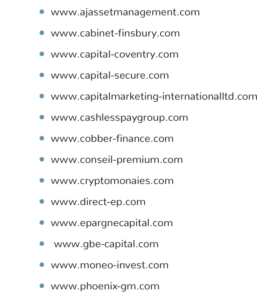

The FSMA black list of cryptocurrency trading platforms now includes a total of 113 websites. The latest additions may be viewed below.

The Belgian regulator would like to note that this list of cryptocurrency trading platforms is based solely on the findings of the FSMA, in particular as a result of consumers’ reports. As such, the list does not include all the companies which might be operating unlawfully in Belgium in that sector.

FSMA started publishing its “black list” of cryptocurrency platforms in February 2018. Back then, the regulator explained that all such entities use the same approaches: they claim to offer the best (or one of the best) trading platform(s), enabling both beginners and professionals to trade in cryptocurrencies in a matter of seconds and with full confidence. Also, some of these platforms offer other financial products with cryptocurrencies as their underlying: savings accounts with supposedly guaranteed returns, servicing rights or derivative products such as CFDs.

Less than a month after Belgium, France also started compiling such a “black list”. The variety of such scams has been significant. In June this year, for instance, France’s AMF published a warning about an individual presenting himself as Stéphane Delaplace who claims to be working at the AMF and to be investigating a trading platform operating via www.union-crypto.com/. The regulator noted that it has no employee called Stéphane Delaplace. Furthermore, the trading platform in question is not authorized to provide services to French residents. The AMF sent the information associated with this case to the public prosecutor’s office.